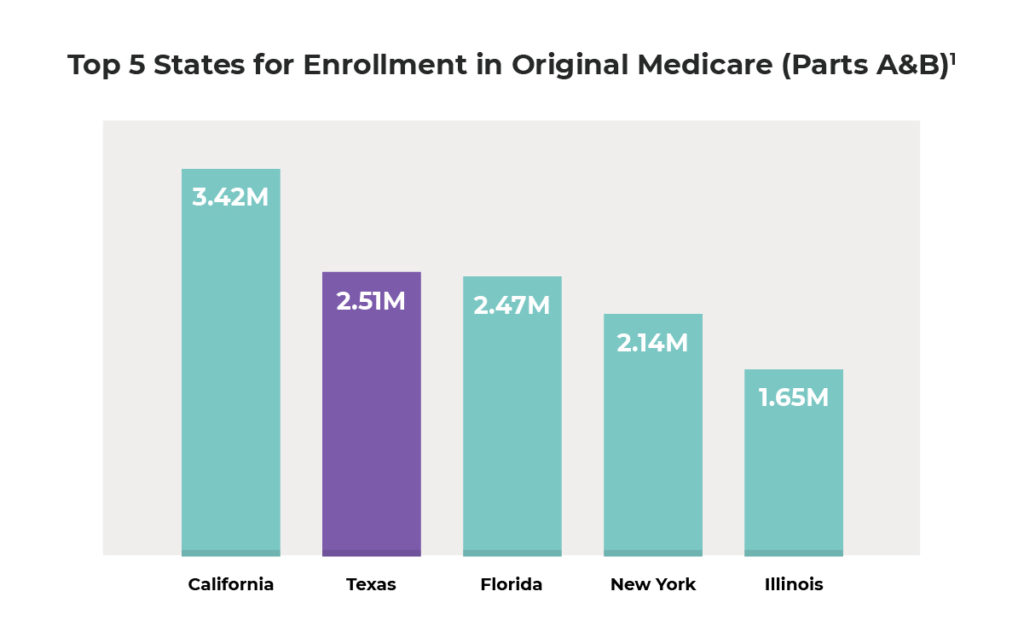

If everything is indeed bigger in Texas, then Medicare coverage is no exception. The Lone Star State is home to more than 3.6 million Medicare beneficiaries, giving it the third-highest number of Medicare insureds in the US behind Florida and California.1 But even with that many people participating in the program, Medicare can still seem convoluted and confusing to most. It doesn’t have to be that way, though. We’ve got the essential info you need to know about Medicare in Texas.

When Am I Eligible for Medicare in Texas?

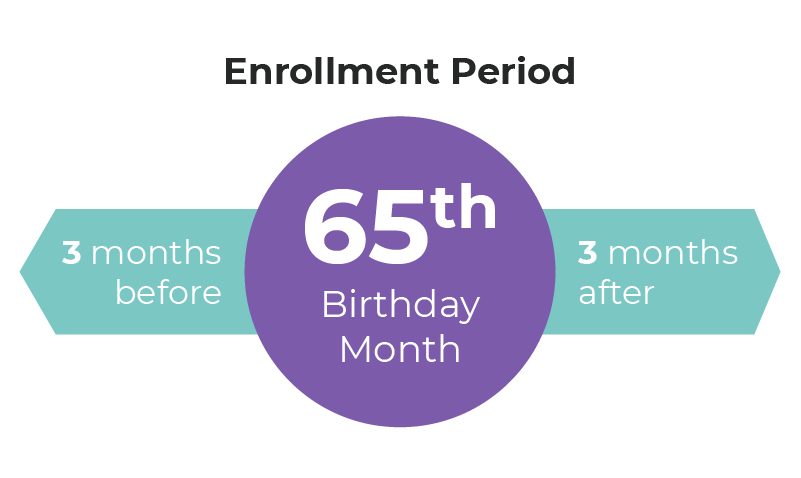

Like any other state, you’ll typically become eligible for Texas Medicare once you reach about sixty-five years of age. The Initial Enrollment Period begins three months before your sixty-fifth birthday month and ends three months after the end of your birthday month.

Individuals younger than the age qualifier can still enroll if they have Amyotrophic Lateral Sclerosis (ALS) or End Stage Renal Disease (ESRD) or have been receiving Social Security Disability Benefits (SSDI) for 24 months. To see if you’re eligible and/or what you can expect to pay for coverage, Medicare has developed easy-to-use eligibility and premium calculators.

How Do I Apply for Medicare in Texas?

Qualifying for Medicare typically means you’re either a US citizen or you’ve been a legal permanent resident of the US for at least five consecutive years.

Residents of the Lone Star State enroll in Medicare about three months before their sixty-fifth birthday month. In order to apply for Medicare coverage, you can visit your local SSA office, enroll over the phone, or sign up online.

- Locate your local SSA office so you can schedule an appointment and pay them a visit.

- Call Social Security at 1-800-772-1213 (TTY users can call 1-800-325-0778), Monday through Friday, from 7 a.m. to 7 p.m.

- Apply online if you meet all of the following requirements:

- You’re at least sixty-four years and nine months old.

- You don’t currently have any Medicare insurance.

- You don’t want to start receiving Social Security benefits at the moment.

- You aren’t currently receiving Social Security retirement, disability, or survivors benefits.

If you have already received benefits from the Social Security Administration (SSA) or the Railroad Retirement Board (RRB) for more than twenty-four consecutive months, you will usually be enrolled in Medicare automatically.

Read more: Get Medicare Quote

Medicare Parts A&B (Original Medicare)

Also known as Original Medicare, Parts A and B are the most essential components of Medicare insurance. Part A refers to hospital insurance that can help pay for inpatient hospital care and follow-up services, while Part B refers to medical insurance that can help pay for outpatient hospital care, doctors’ services, and necessary medical equipment.

Be sure to check out our Medicare 101 page for more specifics on Original Medicare.

Parts A and B are the most common parts of Medicare coverage in the US, and Texas is no exception. In fact, Texas has the second-highest enrollment in Original Medicare in the country.

Medicare Advantage (Part C)

Medicare Part C, also known as a Medicare Advantage Plan, is for individuals who carry Parts A and B but want a little extra coverage. Essentially, an Advantage Plan allows policyholders to choose a private, Medicare-approved insurance provider to get all of their healthcare-related services from. It sometimes requires premium payments on top of what you already pay for Part B.

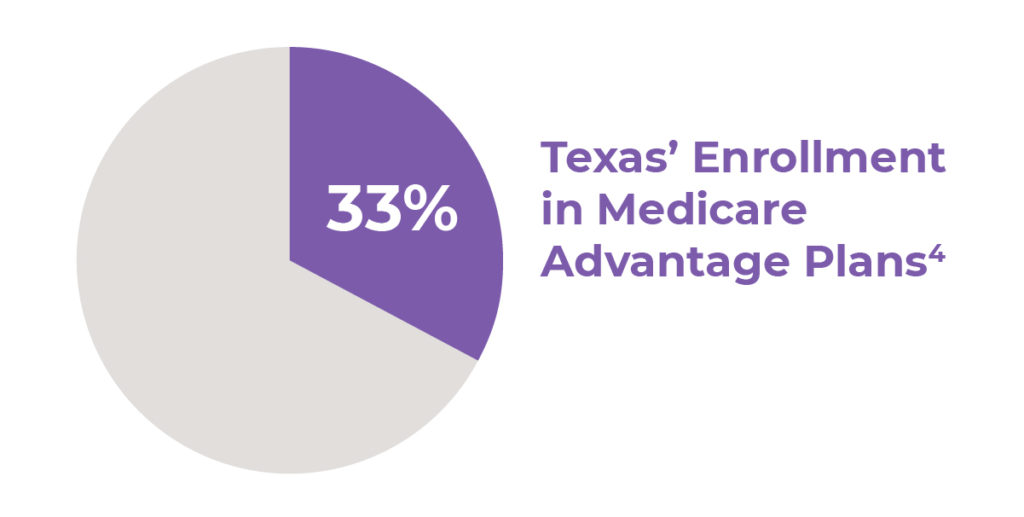

On the other hand, Part C typically includes added benefits that aren’t covered by Original Medicare (Parts A and B), such as vision, dental, and hearing coverage, chiropractic care, and prescription drug coverage. According to the Henry J. Kaiser Family Foundation, 33% of Medicare beneficiaries in Texas were enrolled in Medicare private plans (Part C) in 2017, which matched the national average.4

Medigap Plans in Texas

Medicare Supplement Insurance, also referred to as Medigap, helps pay for out-of-pocket health-related costs that aren’t covered by Parts A and B, like copayments, deductibles, and medical care when traveling outside the US. While Parts A and B typically pay for 80% of medical expenses, Medigap coverage is designed to cover the remaining 20%. Medigap plans are available only with Original Medicare (Parts A and B), but not Part C.

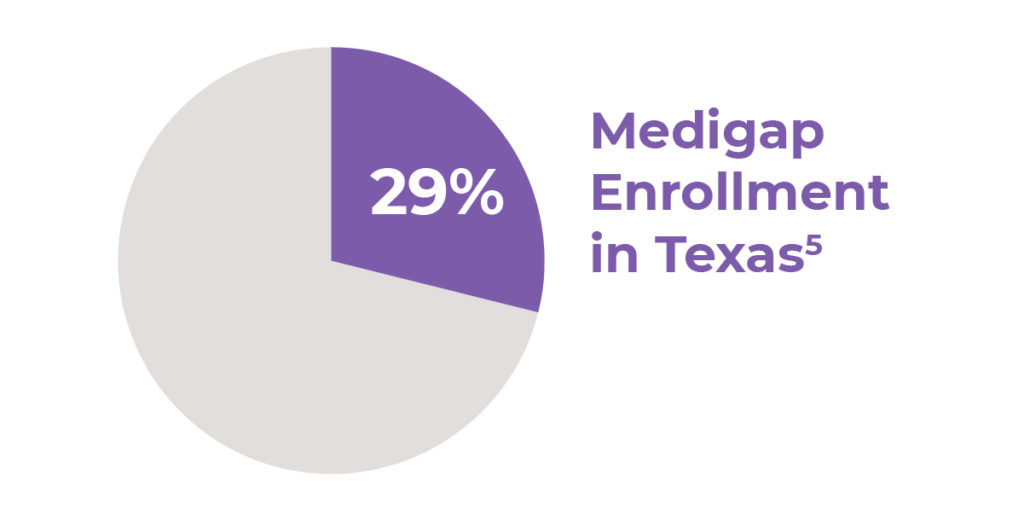

Texas has the second-highest number of Medigap enrollees in the US at over 724,000 as of December 2015. That was roughly 29% of Medicare beneficiaries in the Lone Star State.5

Texas Medicare Resources

While the majority of Medicare programs, resources, and laws are the same across states, Texas does have a few different factors that are worth your consideration:

- Texas Health Information, Counseling, and Advocacy Program: Formed as a partnership between the Texas Health and Human Services system, the Texas Legal Services Center, and the Area Agencies on Aging, this program offers Medicare counseling and information services to those eligible for Medicare.

- The Low-Income Subsidy: Also known as “Extra Help,” this service is provided through Medicare Prescription Drug (Part D) coverage. The Low-Income Subsidy can help individuals with limited incomes and assets to pay their prescription drug costs.

- The Texas Dual Eligible Integrated Care Demonstration Project: In 2014, the Centers for Medicare & Medicaid Services (CMS) announced that the State of Texas was partnering with CMS to “contract with Medicare-Medicaid plans to coordinate the delivery of and be accountable for covered Medicare and Medicaid services for participating Medicare-Medicaid enrollees.”

Final Thoughts: Texas Medicare Doesn’t Have to be a Hassle

The world of Medicare (and health insurance in general) is complex and can be quite confusing for many. But don’t worry there are plenty of licensed, experienced Medicare sales agents in Texas to help answer any questions you may have and help you lock down a Medicare plan that feels best to you. Schedule a consultation with a Medicare agent in your area to see how simple the process can actually be.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Get help from an agent in your area

Sources:

- Henry J. Kaiser Family Foundation, “Total Number of Medicare Beneficiaries”

- US Department of Health and Human Services, “Who is Eligible for Medicare?”

- Centers for Medicare & Medicaid Services, “MDCR Enroll AB 2: Total Medicare Enrollment: Total, Original Medicare, and Medicare Advantage and Other Health Plan Enrollment and Resident Population, by Area of Residence, Calendar Year 2016”

- Henry J Kaiser Family Foundation, “Medicare Advantage 2017 Spotlight: Enrollment Market Update”

- America’s Health Insurance Plans, “Trends in Medigap Enrollment and Coverage Options, 2015”