AAA Auto Insurance Review (2026)

If you’re searching for car insurance, you may want to learn more about AAA auto insurance coverage. AAA car insurance offers coverage options in many U.S. states, and policyholders may be eligible to earn discounts on coverage.

Unfortunately, AAA insurance is not available in every state, and the company’s rates are often higher than average. Still, anyone considering car insurance coverage — especially those with a AAA membership — should consider getting AAA insurance quotes to see how much they would pay for coverage.

What You Should Know About AAA

AAA has an A+ (Superior) financial strength rating with A.M. Best and a stable future outlook. The company also has an A+ rating with the Better Business Bureau (BBB). There are a few customer complaints on the BBB website, but most complaints have been resolved.

AAA policyholders tend to agree that the company’s customer service could use some improvement. Similarly, many customers state that the AAA claims handling process is a bit more complicated than it needs to be, and some claims take too long to be resolved.

Not all AAA customers will recommend the company to their friends and family. Additionally, around 54% of customers are not likely to renew their auto insurance policies with AAA. Therefore, you should consider customer reviews and comments concerning AAA auto insurance before you purchase a policy.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Do I have to be an AAA member to get car insurance?

Purchasing car insurance with AAA often requires that you become an AAA member. The cost of becoming a AAA member varies from one location to the next, usually ranging from $60 to $120 annually.

Most people join AAA because of the company’s roadside assistance coverage, which includes jump starts, towing, emergency fuel delivery, and certain roadside repairs. Additionally, AAA members receive compensation if they’re in an accident more than 100 miles from home.

Lastly, AAA members enjoy certain perks like discounts on hotel stays, cheaper rental cars, and deals on airfare. And anyone who purchases trips through AAA will receive coverage via AAA’s travel accident insurance.

AAA Insurance Coverage Options

AAA offers several options for car insurance coverage. Exact options for coverages, benefits, and discounts vary based on where you live, but some of the most common options for AAA auto coverage include:

- Bodily injury liability

- Property damage liability

- Collision auto insurance

- Comprehensive auto insurance

- Uninsured/underinsured motorist coverage

- Medical payment coverage

- Personal injury protection insurance

- Gap insurance

- Rental car reimbursement

- Rental car insurance

- Non-owner auto insurance

- Pet injury coverage

- Accident forgiveness

Individuals can purchase coverage that adds up to a full coverage policy — including liability, collision, and comprehensive insurance — through most AAA clubs. Still, you’ll need to speak with a representative of an AAA club in your area to ensure you know what options are available to you.

AAA Membership Cost: Is AAA worth the cost?

Roadside assistance is a popular option when shopping for extra car insurance coverage. AAA roadside assistance has various benefits, from jumpstart assistance to discounts on attractions.

However, the price tag for AAA membership is higher than some of the best roadside assistance, so unless drivers take advantage of all the perks, they’re better off choosing a cheaper program.

Read on to discover our AAA insurance review, from the cost and benefits to deciding if AAA is right for you.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

AAA Membership Cost

AAA has three different membership levels, each offering different benefits. The prices we listed are the normal prices, though you may get a lower price during one of the AAA’s sign-up deals.

For example, in the past, AAA has offered a 50% discount on their membership prices and waived the $20 sign-up fee for new members who enrolled in autopay. Take a look at the standard prices below.

[table “4752” not found /]

These are the basic costs listed on AAA’s membership website. However, as stated earlier, how much it costs also depends on any promotions and deals AAA might be running. If the cost seems too high, it might be best to wait for a promotion to get a cheaper annual fee.

Now that we’ve covered the cost of AAA membership, it’s time to consider the benefits to determine if the higher price tag is worth it for drivers. If you’re a senior, you may want to compare AAA vs. AARP Auto Insurance.

AAA Membership Benefits

AAA offers all the basic benefits of a roadside assistance program. The benefits vary slightly by membership level. The table below covers the basic roadside assistance benefits.

[table “4751” not found /]

In addition to roadside benefits, drivers can take advantage of several additional discounts and benefits. Some of the other benefits include:

- AAA rewards and discounts. Taking advantage of some of the best AAA discounts is one of the easiest ways to make your membership worth it. You can get discounts for dining, movies, attractions, and more.

- Identity theft protection. AAA offers identity theft protection with all membership levels, such as lost wallet assistance and credit monitoring.

- Discounted passport photos. AAA offers free passport photos with the highest membership level or $10 and below for the other levels.

- Vehicle pricing reports. You can get free vehicle pricing reports through AAA.

- Vacation packages. AAA offers travel guides, discounts on travel tickets, and more.

These are just a few of the perks of a AAA membership. If you sign up, take advantage of as many perks and discounts as possible.

Deciding if AAA is Right For You

AAA may be a good choice if you want a roadside assistance program with plenty of perks for traveling and shopping. The higher price for a AAA membership can pay itself off if you take advantage of all the perks. You can also reduce the initial cost by taking advantage of sign-up deals.

However, AAA may not be for you if you want a simple, cheap roadside assistance program. You can see if your auto insurance company offers roadside assistance as an add-on. Generally, signing up with a car insurance company’s roadside assistance is relatively cheap.

The bottom line is that it is worth the cost if you use all the perks and discounts provided by AAA and travel often. If you don’t think you’ll use the services provided by AAA, you’re better off with a cheaper roadside assistance program.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

The Final Word on AAA Membership Costs

AAA is more expensive than other roadside assistance programs, but the perks and benefits offset the cost. You can also take advantage of sign-up deals to lower the initial sign-up cost.

However, if you don’t use the perks of AAA, you’re better off with another company with one of the best roadside assistance plans.

AAA Insurance Rates Breakdown

There are many factors that affect auto insurance rates, such as:

- Age

- Gender

- Marital status

- Car make and model

- ZIP code

- Credit score

- Driving history

- Coverage types

Still, AAA auto insurance quotes typically indicate that a car insurance policy with AAA is often more expensive than a policy with other competitors. The table below shows the average full coverage auto insurance rates of the top insurance companies as well as the national average.

[table “4784” not found /]

You can expect, full coverage rates with AAA to be nearly 58% higher than the national average. And this trend is common in most AAA auto insurance rates.

The following table shows liability auto insurance coverage rates, and AAA is often 56% higher than the national average.

[table “4785” not found /]

Similarly, auto insurance for people with bad credit is likely to cost around 76% higher than the national average. Auto insurance for drivers with a DUI could cost approximately 97% higher than the national average.

Unfortunately, nearly every category shows that AAA requires policyholders to pay rates that are significantly higher than other insurance providers:

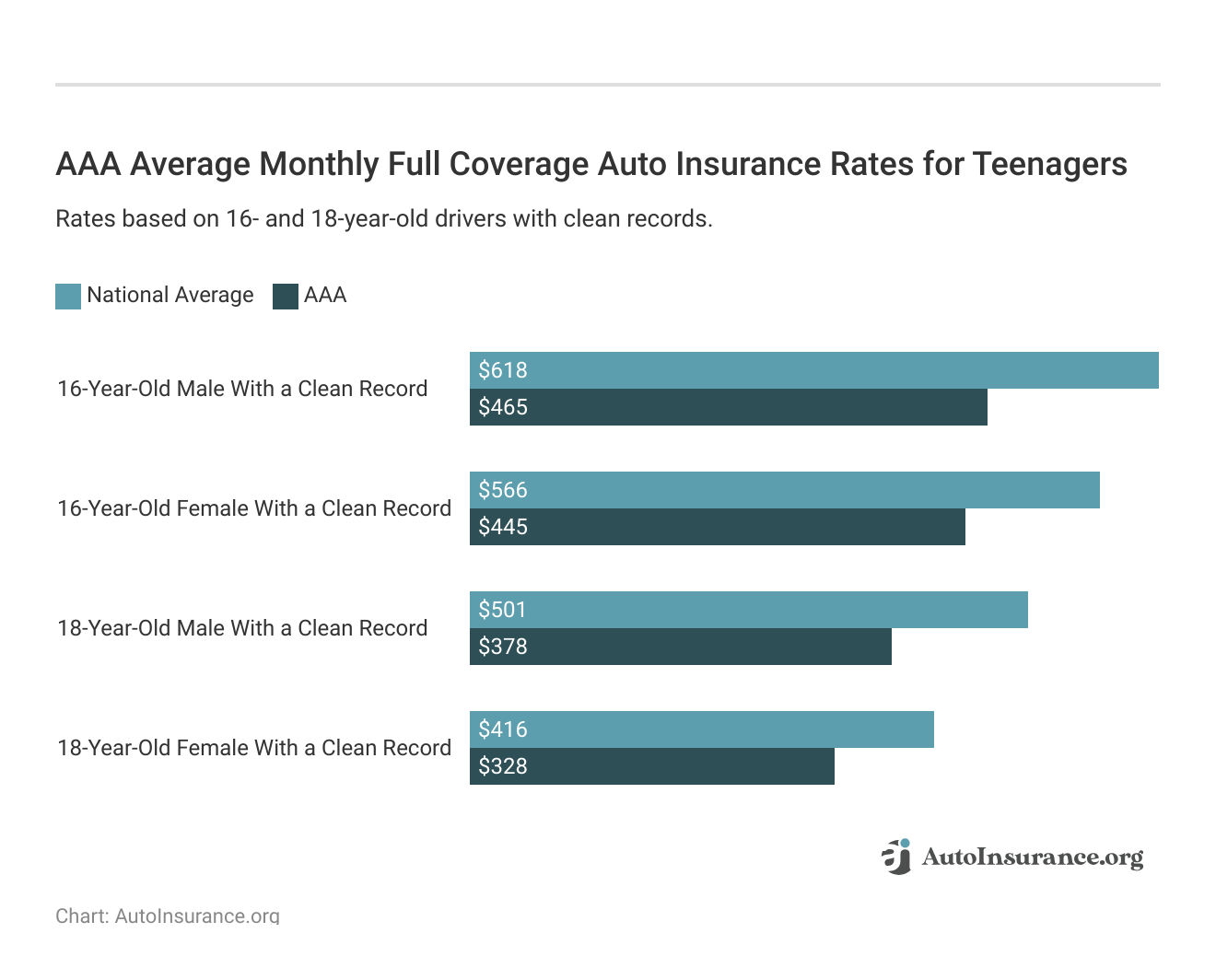

- Rates on auto insurance for teens are around 20% higher than the national average.

- Rates for young adult drivers are 55% higher than the national average.

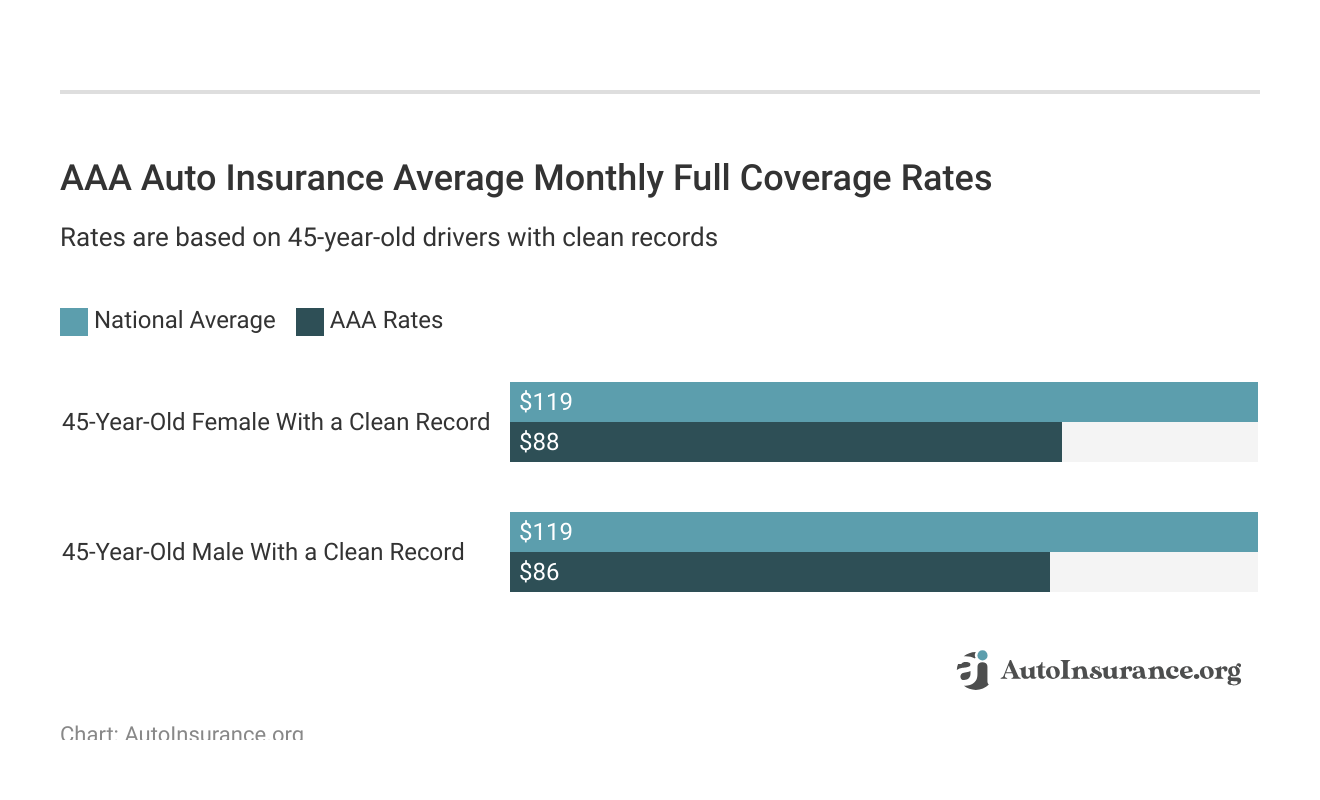

- Rates for adult drivers are 53% higher than the national average.

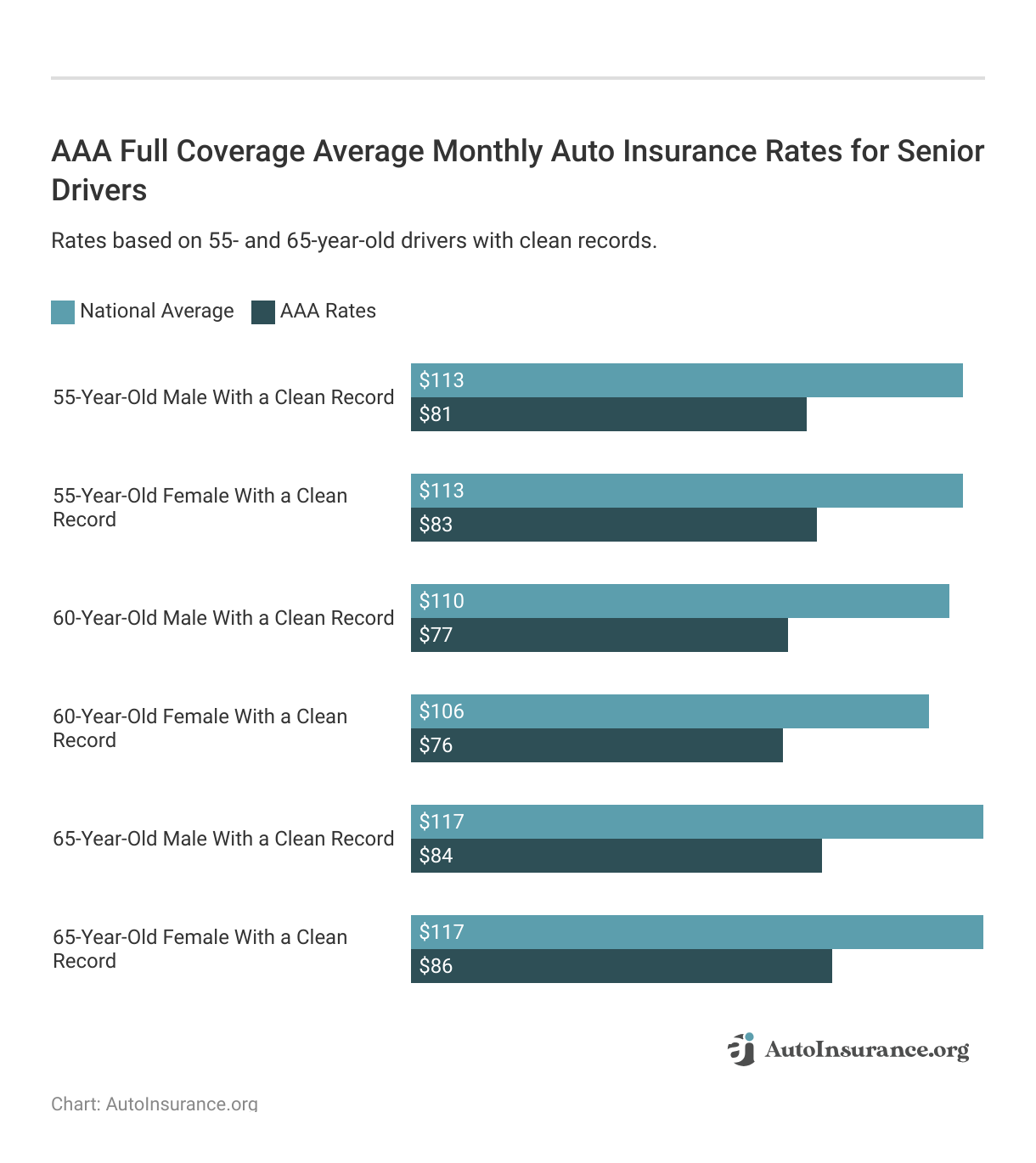

- Rates on auto insurance for seniors are 58% higher than the national average.

- Rates following a speeding ticket are 68% higher than the national average.

- Rates following a car accident are 57% higher than the national average.

The chart below shows AAA full coverage auto insurance rates for teenagers compared to the national average.

Comparitively, here are AAA’s annual full coverage rates for 45-year-old drivers.

And here are how AAA’s full coverage rates for senior drivers stack up against the national average.

If you’re considering purchasing an auto insurance policy with AAA, you should compare AAA car insurance quotes to quotes from other companies.

It’s unlikely you’ll find cheap car insurance with AAA, and comparing quotes will help you determine which company would work best for you and your family.

AAA Discounts Available

When you get AAA auto insurance quotes, you may want to learn how to lower your insurance costs. Luckily, AAA offers many different discount options to its members and policyholders. Some of the company’s most common auto insurance discounts include:

- Education discount

- Occupation discount

- Anti-theft device discount

- Loyalty discount

- Safe driver discount

- Good student discount

- New driver discount

- Student away from home discount

- Driver training course discount

- Multi-car discount

- Multiple-policy discount

- Paid-in-full discount

- Automatic payment discount

Much like AAA’s coverage options, the company’s discounts vary from one state and location to the next. Again, you’ll need to speak with an AAA representative in your area to learn more about discounts you may be eligible for.

Does AAA offer usage-based insurance discounts?

AAA uses the AAA Driver Program to monitor drivers’ specific habits on the road.

Policyholders who enroll in the program may save up to 20% on their auto insurance policies by allowing the company to monitor their average speed, distracted driving habits, fatigue behind the wheel, braking habits, and other factors.

Free Insurance Comparison

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption