A Deep Look At Arizona Auto Insurance Costs

If you have one of the Four Corners of The U.S. right in your back yard or root for the Cardinals, you can find the inside scoop for cheapest car insurance rates, best companies, and more here.

What Can We Help You Find?

- Arizona’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Arizona Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

Arizona’s Cheapest Insurance Companies

Spoiler alert: MGA Insurance, The Hartford, and Titan get the gold, silver, and bronze for Arizona’s cheapest car insurance. That’s all based on our analysis of data from The Arizona Department of Insurance—generating annual rates from 66 companies in 10 cities, and four driver profiles. If you’d like to see where Arizona drivers may be able to find the cheapest coverage, the chart below is a start based on our research.

| Cheapest Car Insurance in Arizona | Average Rate |

|---|---|

| MGA Insurance | $1,249.60 |

| The Hartford | $1,323.95 |

| Titan | $1,379.45 |

| PEKIN | $1,723.05 |

| MetLife | $1,768.30 |

| Geico | $1,780.00 |

| Acuity | $1,805.10 |

| Auto Owners Group | $1,816.40 |

| Horace Mann | $1,877.75 |

| Civil Service Employees | $1,962.00 |

| 21st Century | $1,997.26 |

| Kingsway | $2,065.85 |

| Amica Mutual | $2,067.20 |

| WBL Group | $2,068.50 |

| Safeco | $2,070.00 |

| Country Insurance | $2,071.70 |

| Fairfax | $2,098.40 |

| Nationwide | $2,117.23 |

| MAPFRE | $2,202.73 |

| Mutual of Enumclaw | $2,204.44 |

| USAA | $2,250.70 |

| Travelers | $2,265.42 |

| American National Financial | $2,274.11 |

| Progressive | $2,298.75 |

| QBE Insurance | $2,299.32 |

| Allstate | $2,348.82 |

| Ameriprise | $2,359.25 |

| State Farm | $2,468.06 |

| Badger Mutual | $2,488.97 |

| Pharmacists Mutual | $2,497.30 |

| State Auto Mutual | $2,528.73 |

| AssuranceAmerica | $2,544.00 |

| Farmers | $2,553.47 |

| Western General | $2,560.15 |

| Safe Auto Insurance | $2,587.16 |

| Infinity | $2,593.17 |

| Safeway | $2,609.27 |

| Western National | $2,612.00 |

| Anchor Insurance | $2,629.10 |

| Cincinnati Insurance | $2,647.31 |

| Loya Insurance | $2,659.83 |

| Main Street America | $2,662.91 |

| Liberty Mutual | $2,668.30 |

| KEMPER CORP GRP | $2,673.64 |

| Hallmark Financial | $2,710.31 |

| Esurance | $2,760.70 |

| Secura | $2,770.53 |

| National General | $2,799.94 |

| Mercury | $2,800.00 |

| CSAA | $2,826.00 |

| ACE | $2,837.60 |

| American Access | $2,849.86 |

| American Independent | $2,925.68 |

| Center Mutual | $2,957.22 |

| Primero Insurance | $2,964.00 |

| United Home Insurance | $2,971.77 |

| Iowa Farm Bureau | $2,991.50 |

| Access Insurance | $3,017.14 |

| Secura Insurance | $3,079.00 |

| United Automobile | $3,128.29 |

| American Family | $3,167.83 |

| Chubb | $3,303.94 |

| Dairyland | $3,564.80 |

| Southwest General | $3,766.60 |

| Electric | $3,865.80 |

| EMC Insurance | $5,239.00 |

Read more: Top Choice For Your Ameriprise Insurance Needs

How much do drivers like you spend on auto insurance?

Whether you’re a teenager, an established married couple, or a single female over 40, you’ll be quoted a different auto insurance premium. To help gauge what you might pay for auto insurance, we calculated premiums based on data gathered for a driver with one minor violation (such as a ticket), 15,000 annual mileage, and minimum state liability coverage. All of the cars used were different, a factor that can make premiums vary. This is a good start to see where you’ll find the cheapest coverage for your age group.

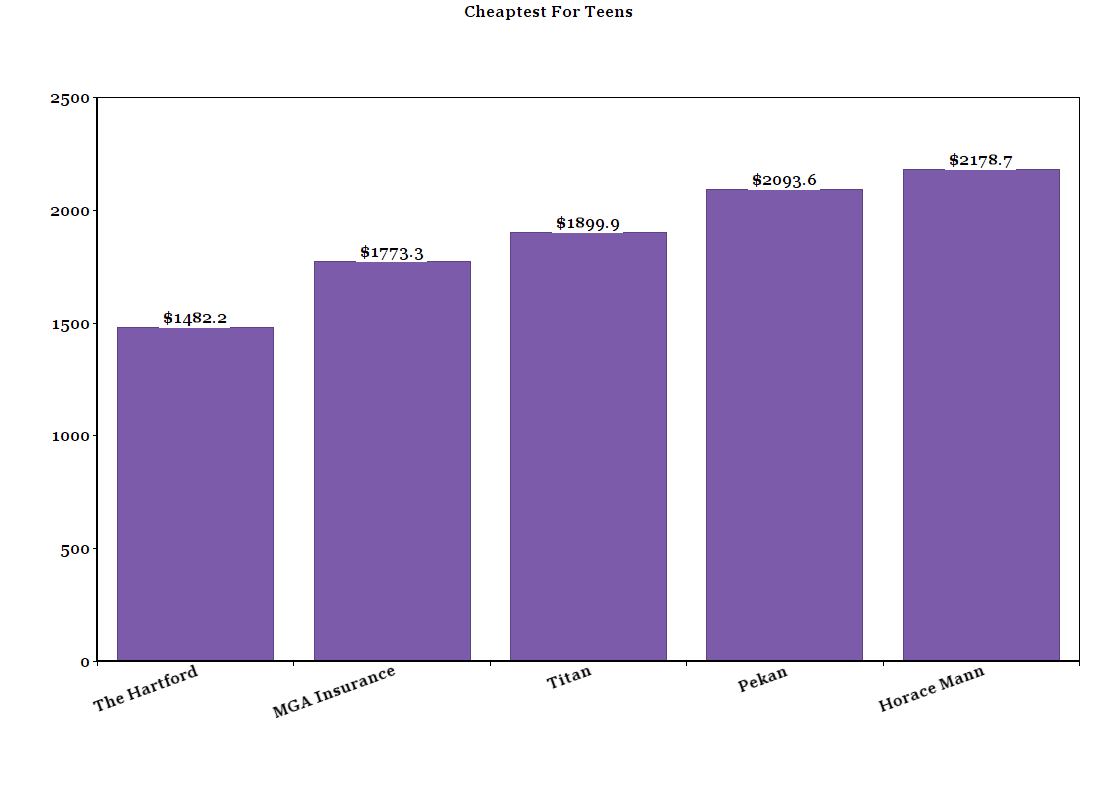

What auto insurance companies have the cheapest average rates for teens?

Teen drivers are a unique group to insurance companies because they statistically get into more accidents than any other demographic. If you’re looking for affordable car insurance as a teen driver, you’ll want to go with a company that has plans tailored to you. We analyzed rates from both 18 year old men and women, and found that men will pay roughly 2% more. The Hartford is the most affordable and is about $300 cheaper than MGA Insurance–the second cheapest. Based on price alone, here are the five cheapest average annual rates we found for teen drivers by company.

What auto insurance companies have the cheapest average rates for young adults?

What do Babe Ruth, Abe Lincoln, and Robert E. Lee all have in common? They were customers of The Hartford. This could be because The Hartford has the cheapest auto insurance rates for male drivers who are 21 or younger with a clean driving record, according to our research. If you’re in this age group, here’s where you may find the cheapest rates in Arizona.

| Average Annual Rate | |

|---|---|

| The Hartford | $1,594.40 |

| MGA Insurance | $1,889.60 |

| Titan | $2,056.60 |

| Pekin | $2,151.00 |

| Horace Mann | $2,287.40 |

What auto insurance companies are cheapest for drivers over 40?

We compared rates provided for drivers over 40, and found that MGA Insurance has the lowest rate by $134, regardless of gender. See how much car insurance may cost you if you’re over 40 in Arizona:

| Average Annual Rate | |

|---|---|

| MGA Insurance | $725.90 |

| Titan | $859.00 |

| Geico | $950.00 |

| The Hartford | $1,165.70 |

| Kingsway | $1,197.80 |

| Mutual Of Enumclaw | $1,262.70 |

| 21st Century | $1,331.00 |

| USAA | $1,338.20 |

| Pekin | $1,352.50 |

| MAPFRE | $1,361.10 |

| Travelers | $1,364.10 |

| Ameriprise Financial | $1,376.30 |

| American National Financial | $1,426.60 |

| QBE | $1,576.00 |

| Horace Mann | $1,576.80 |

| State Farm | $1,583.10 |

| Nationwide | $1,584.20 |

| State Auto Mutual | $1,669.60 |

| MetLife | $1,768.30 |

| Western National Mutual | $1,791.90 |

Read more: Everything You Need To Know About Auto Insurance Costs In Arizona

What auto insurance companies are cheapest for married drivers?

Our findings shows that your marital status matters in Arizona when it comes to getting cheaper premiums. Based on married couples who are 42-years old, here are the companies that offer cheap car insurance in the state for you:

| Average Annual Rate | |

|---|---|

| MGA Insurance | $816.60 |

| Titan | $1,035.80 |

| Kingsway | $1,100.80 |

| Geico | $1,236.80 |

| 21st Century | $1,433.80 |

| The Hartford | $1,487.00 |

| Ameriprise Financial | $1,579.00 |

| Mutual Of Enumclaw | $1,593.40 |

| USAA | $1,638.80 |

| MAPFRE | $1,668.40 |

What auto insurance companies are cheapest for female drivers?

Women statistically get into fewer accidents than men especially when they’re in their teens. Our research shows that women’s rates are generally less than men’s a fact that coincides with national trends. Below, you’ll find the cheapest Arizona car insurance annual premiums for an average female drivers.

What are the average city rates?

Scottsdale is only 13 miles from Phoenix, but our research shows that drivers pay about $147 less there than in the big city. Flagstaff which is 30% college students is also one of the cheapest Arizona cities for auto insurance. After looking at data and running some numbers, here are the averages for your neighboring cities:

| Arizona Insurance by City | Average Annual Rate |

|---|---|

| Sierra Vista | $2,210.04 |

| Flagstaff | $2,341.64 |

| Yuma | $2,398.09 |

| Tucson | $2,490.38 |

| Nogales | $2,501.27 |

| Casa Grande | $2,517.75 |

| Mesa | $2,531.36 |

| Scottsdale | $2,590.80 |

| Phoenix | $2,737.70 |

| Glendale | $2,809.30 |

Who are the most popular Arizona car insurance carriers?

Market share shows the percentage of customers a company has compared to rivals. It can also show you how a company is doing as a whole. For instance, our data shows that State Farm is pretty pricey compared to other providers, but it has the largest market share in Arizona. Some of the cheapest providers in Arizona such as MGA and Titan don’t make the top ten for customer popularity. The Hartford which is one of the cheaper options only holds a small portion of the state’s insured drivers too.

| Market Share % | Average Premiums | |

|---|---|---|

| State Farm | 17.47 | $2,468.06 |

| Geico | 12.81 | $1,780.00 |

| Progressive | 9.94 | $2,298.75 |

| Farmers | 9.42 | $2,553.47 |

| Allstate | 8.6 | $2,348.82 |

| USAA | 7.13 | $2,250.70 |

| American Family | 6.03 | $3,167.83 |

| Liberty Mutual | 5.27 | $2,668.30 |

| The Hartford | 2.77 | $1,323.95 |

| CSAA Insurance | 2.13 | $2,826.00 |

This could mean that people are paying more for coverage if it comes with better options and customer service. Take a look to see how popular Arizona insurance companies are and decide for yourself.

What are the customer satisfaction ratings?

A“complaint index” shows the percentage of customers who complain compared to the amount a company has in that area (market share). What you need to know is that the lower the number, the less complaints a company is getting.

In Arizona, we found that all of the top ten auto insurance providers have zero complaint indexes. See for yourself with the index below.

| Complaint Ratio | |

|---|---|

| The Hartford | 0 |

| Pekin | 0 |

| Horace Mann | 0 |

| Titan | 0 |

| MGA | 0 |

| Geico | 0 |

| Pharmacists Mutual | 0 |

| USAA | 0 |

| IDS Property Casualty | 0 |

| Safe Auto | 0 |

| Southwest General | 0 |

| Mendota | 0 |

| American National | 0 |

| Travelers | 0 |

| Unigard | 0 |

| CSAA | 0 |

| Kemper Independence | 0 |

| American Family | 0 |

| Secura Supreme | 0 |

| Mutual of Enumclaw | 0 |

| Bankers Standard | 0 |

| Arizona Automobile | 0 |

| Badger Mutual | 0 |

| National General | 0.029 |

| Pacific Insurance | 0.036 |

| Farmers Insurance Company of AZ | 0.04 |

| State Farm | 0.043 |

| Allstate | 0.064 |

| Milbank | 0.065 |

| Permanent General Assurance | 0.067 |

| United Automobile | 0.069 |

| Primero | 0.075 |

| 21st Century | 0.077 |

| Omni Insurance | 0.078 |

| Cincinnati Insurance | 0.081 |

| MAPFRE | 0.084 |

| Infinity | 0.088 |

| Austin Mutual | 0.088 |

| Western General | 0.091 |

| Hallmark | 0.099 |

| AssuranceAmerica | 0.102 |

| Mercury | 0.121 |

| Access | 0.131 |

| Progressive Advanced | 0.136 |

| Loya | 0.147 |

| American Access Casualty | 0.198 |

| Anchor General | 0.199 |

| United Insurance | 0.2 |

| Safeway | 0.2 |

| Allied Property and Casualty | 0.205 |

What’s the bottom line?

We’re in the business of bringing you the facts about auto insurance so you can decide what’s best for you. Here is what the facts tell us:

Want an all-around great company?

The Hartford and Geico ranked in the top ten for market share, cheapest insurance, and low customer complaints. Horace Mann, USAA, Titan, and Pekin ranked top ten for two of those categories: cheapest insurance and low customer complaints.

Going for low cost only?

MGA, The Hartford, Titan, Pekin, and Metlife are the cheapest in the state—according to our data.

What should you do next?

Depending on whether you’re in the busy city of Phoenix or sweating in the desert, you’ll need to call and around and get auto insurance quotes if you want accurate premiums. In addition to the demographics discussed above, your auto insurance costs will depend on factors like your credit score, your driving record, and the insurance coverage options you choose for your policy. Keep in mind that drivers with a clean record will have a much easier time finding cheap auto insurance than high-risk drivers with multiple infractions.

Talking to a licensed agent is the best advice we can give you when it comes to insurance shopping. See what they can do for you when you call [mapi-phone /].

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Read more: Arizona Car Insurance Requirements

Where We Found The Facts

The rates you see here were pulled from The Arizona Department of Insurance. We took all the data and analyzed it to give you a better idea of what to look for as an Arizona driver, but this doesn’t mean that will be the premium you’ll pay. Every driver has his/her own record, age, gender, and more differing details, so you can expect a different premium than your friends. We just wanted to show you what average drivers pay for auto coverage in Arizona so you can base your insurance shopping off of something.

Source Links:

- The Arizona Department of Insurance

- Arizona Demographics