Are you tired of looking at four or more websites just to find the information you are looking for? We thought so. When it comes to cheapest car insurance in Illinois, everything you need is right here. If you root for the Bears, this was written for you.

What Are You Looking For?

- Cheapest Companies In Illinois

- How Much Drivers Like You Spend On Auto Insurance

- City Rates In Illinois

- Most Popular Illinois Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are the cheapest companies in Illinois?

We took information from 10 cities, four driver profiles, and 12 companies to calculate these average auto premiums by car insurance company. We also used a driver with a 2013 Honda Civic LX (4-door), good credit, and no accidents for these premiums.

You’ll find that State Farm, Allstate, and Nationwide—companies all headquartered in or close to Illinois—are some of the cheapest options. Take a look to see where you might find the most affordable auto policies in Illinois in our chart below. (For more information, read our “What You Need To Know About Auto Insurance Costs In Illinois“).

| Illinois Car Insurance Companies | Average Annual Rate |

|---|---|

| Nationwide | $746.62 |

| American Family | $773.22 |

| State Farm | $780.62 |

| Farmers | $788.10 |

| Allstate | $986.26 |

| Travelers | $1,237.60 |

| Geico | $1,458.29 |

| Allied | $1,501.59 |

| MetLife | $1,593.93 |

| Country Financial | $1,804.83 |

| Liberty Mutual | $2,462.67 |

| AAA | $2,479.11 |

Read more: Nationwide Vs AAA

How much drivers like you spend on auto insurance?

We know that insurance companies base auto insurance premiums on a lot of individual factors. The averages we calculated below will help give you a better idea of the rates certain groups of people pay for car insurance in Illinois.

Cheapest For Teen Drivers

Auto insurance rates for teen drivers in Illinois range from $750 to $3,300—and even more depending on if you’re a boy or girl. We found that teen boys will pay about 30% more for policies than girls, but Allstate, Nationwide, and State Farm are the cheapest options for both. In fact, Allstate is nearly 300% cheaper than Illinois’ most expensive insurer for teens, Country Financial.

Check out the average premium for teens that we based on 18-year old guys and girls.

| Cheapest for Teens | Average Annual Rate |

|---|---|

| Allstate | $743.72 |

| Nationwide | $783.86 |

| State Farm | $922.83 |

| American Family | $1,014.83 |

| Farmers | $1,693.10 |

| Geico | $1,795.17 |

| Liberty Mutual | $2,392.07 |

| Travelers | $2,721.72 |

| Allied | $2,735.86 |

| AAA | $3,043.03 |

| Country Financial | $3,311.38 |

Read more: 8 Easy Steps To Switch Your Auto Insurance

Cheapest For Young Adults

Based on our data, rates for car insurance will typically drop about 20% between the ages of 18 and 25. Men will see a bigger decrease of 23% while women will pay about 19% less from 18 to 25. We found that Country Financial, Farmers, and Travelers are where you’ll see the biggest drops in price—from a staggering 58% to 72%, respectively.

While we recommend shopping for car insurance annually, if you want to select a company and then not switch, these may be good options to help you save. If you’re a young driver, see where the cheapest car insurance policies are for you by checking out the chart.

| Cheapest for Young Adults | Average Annual Rate |

|---|---|

| Farmers | $625.52 |

| American Family | $746.93 |

| Travelers | $760.90 |

| State Farm | $813.38 |

| Nationwide | $828.48 |

| Allstate | $1,208.07 |

| Allied | $1,325.59 |

| Country Financial | $1,388.21 |

| Geico | $1,545.86 |

| MetLife | $1,593.93 |

| AAA | $2,658.00 |

| Liberty Mutual | $2,817.52 |

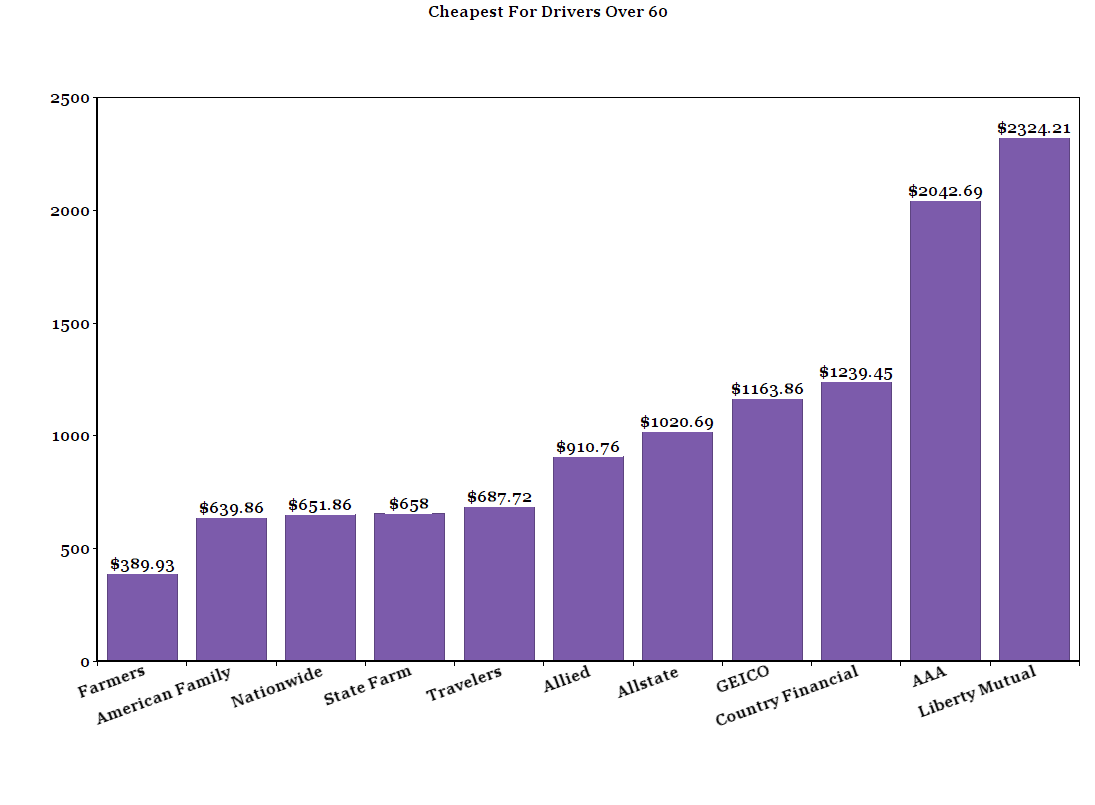

Cheapest For Drivers Over 60

Drivers over 60 pay hundreds less than other insured drivers. We discovered through our research that Farmers is by far the cheapest, but Liberty Mutual—the most expensive in this category—is still cheaper for older drivers than it is for the average Joe. Take a look.

Rates For Men And Women

Men and women won’t pay the same rates for car insurance in Illinois—or most places for that matter. No matter what kind of driver you are, guys pay about 17% more on average than the ladies. The five cheapest car insurance providers for men and women are all the same, but see how much their prices vary from male to female by looking at the chart below.

What Married Vs Single Drivers Pay For Premiums

After doing a lot of data analysis, we discovered that married couples pay about 70% less for car insurance than single drivers. Take Farmers for example–its rates for married drivers is almost $800 less than those for its single customers in our analysis. We did base these averages on single drivers 25 and under and married drivers 40 and 60, so it might have a little bit to do with that age range.

| Married | Single | |

|---|---|---|

| Farmers | $389.93 | $1,159.31 |

| American Family | $639.86 | $883.23 |

| Nationwide | $651.86 | $806.17 |

| State Farm | $658.00 | $868.10 |

| Travelers | $687.72 | $1,741.31 |

| Allied | $910.76 | $2,030.72 |

| Allstate | $1,020.69 | $975.90 |

| Geico | $1,163.86 | $1,670.52 |

| Country Financial | $1,239.45 | $2,349.79 |

| AAA | $2,042.69 | $2,853.89 |

| Liberty Mutual | $2,324.21 | $2,604.79 |

Read more: Does Car Insurance Drop at 25?

What are the city rates?

Even though Naperville is only 30 miles from Chicago, insured drivers will pay about $800 less a year than in the Windy City. Check out the rates for other Illinois cities to see what you could pay for an insurance policy there based on our calculations.

| Illinois Car Insurance by City | Average Annual Rate |

|---|---|

| Normal | $1,021.87 |

| Bloomington | $1,070.18 |

| Champaign | $1,082.04 |

| Naperville | $1,123.02 |

| Milan | $1,125.24 |

| Lovington | $1,182.40 |

| Elgin | $1,212.44 |

| Wheaton | $1,229.96 |

| Rockford | $1,239.78 |

| Decatur | $1,247.47 |

| Arlington Heights | $1,253.47 |

| Tinley Park | $1,317.11 |

| Aurora | $1,317.38 |

| Peoria | $1,318.98 |

| Schaumburg | $1,321.78 |

| Waukegan | $1,385.56 |

| Palatine | $1,388.23 |

| Mount Prospect | $1,395.60 |

| Bolingbrook | $1,396.44 |

| Hoffman Estates | $1,412.62 |

| Joliet | $1,422.80 |

| Berwyn | $1,473.29 |

| Oak Lawn | $1,506.36 |

| Des Plaines | $1,550.76 |

| Evanston | $1,577.96 |

| Skokie | $1,618.27 |

| Cicero | $1,771.78 |

| Orland Park | $1,868.98 |

| Chicago | $1,911.95 |

Read more: Get The Best Affordable Auto Insurance In Aurora

What are the most popular California car insurance carriers?

What you call “popular,” we like to call “market share.” It means the percentage of auto insurance customers a company has compared to its competitors.

Market share tells you a lot about a company. We found that State Farm has the most customers out of any other insurance company in Illinois. It isn’t the cheapest option though. They’re actually the third cheapest in the state based on our premium averages.

This is why it’s important to look at market share. It can show you hidden factors that are causing more customers to pay more for service from certain insurance companies—like coverage options and customer service. Look at the data below to see the most popular car insurance companies in Illinois.

| Market Share % | Average Premiums | |

|---|---|---|

| State Farm | 31.81 | $780.62 |

| Allstate | 11.63 | $986.26 |

| Country Insurance | 6.97 | $1,804.83 |

| Geico | 5.82 | $1,458.29 |

| Farmers | 4.72 | $788.10 |

| Progressive | 4.68 | N/A |

| American Family | 4.33 | $773.22 |

| Liberty Mutual | 3.09 | $2,462.67 |

| USAA | 2.12 | N/A |

| MetLife | 1.72 | $1,804.83 |

What are the customer satisfaction ratings?

A “complaint index” shows the percentage of customers who complain compared to a company’s market share. The lower the percentage, the less complaints a company gets from customers. Country Mutual Insurance Company has the lowest complaint index of those we surveyed in Illinois and American Heartland Insurance has one of the worst.

| Company | # of Complaints | 2014 Direct Written Premiums | Complaint Ratio Per $1 Million in Premiums |

|---|---|---|---|

| Country Mutual Insurance Company | 35 | 431,289,064 | 0.08 |

| Auto Owners Ins | 5 | 48,282,111 | 0.10 |

| State Farm | 270 | 2,005,715,188 | 0.13 |

| Safeco | 13 | 91,677,550 | 0.14 |

| Liberty Mutual | 15 | 96,783,320 | 0.15 |

| Travelers | 12 | 77,315,889 | 0.16 |

| Progressive | 44 | 275,412,869 | 0.16 |

| USAA | 16 | 98,221,439 | 0.16 |

| Allstate | 110 | 661,229,117 | 0.17 |

| Erie Insurance | 13 | 68,209,514 | 0.19 |

| West Bend Mutual Insurance Company | 5 | 25,371,373 | 0.20 |

| Farmers | 68 | 339,397,893 | 0.20 |

| Esurance | 10 | 47,614,934 | 0.21 |

| The Hanover Grp | 9 | 41,775,888 | 0.22 |

| American Family | 56 | 251,241,890 | 0.22 |

| Auto Club Insurance Association | 14 | 52,791,565 | 0.27 |

| The Hartford | 14 | 51,236,271 | 0.27 |

| Geico | 97 | 339,026,250 | 0.29 |

| Madison Mutual Insurance Company | 8 | 23,710,918 | 0.34 |

| State Auto Mutual | 8 | 19,096,163 | 0.42 |

| MemberSelect Insurance Company | 13 | 28,873,996 | 0.45 |

| Loya Insurance Company | 5 | 10,413,116 | 0.48 |

| 21st Century | 13 | 17,767,921 | 0.73 |

| Affirmative Insurance | 15 | 15,655,018 | 0.96 |

| Safeway | 18 | 13,992,143 | 1.29 |

| Pekin Insurance | 8 | 6,189,525 | 1.29 |

| Safe Auto Insurance Company | 18 | 12,819,614 | 1.40 |

| Falcon Insurance Company | 12 | 8,472,378 | 1.42 |

| Mendakota Insurance Company | 31 | 17,786,124 | 1.74 |

| National Heritage Insurance Company | 5 | 2,857,082 | 1.75 |

| American Access Casualty Company | 170 | 95,938,333 | 1.77 |

| Founders Insurance Company | 135 | 48,970,182 | 2.76 |

| First Chicago Insurance Company | 22 | 7,595,076 | 2.90 |

| Lighthouse Casualty Company | 243 | 71,690,351 | 3.39 |

| American Alliance Casualty Company | 51 | 14,397,870 | 3.54 |

| Western National | 99 | 20,752,133 | 4.77 |

| Direct Auto Insurance Company | 99 | 20,000,200 | 4.95 |

| American Heartland Insurance Co | 194 | 24,334,225 | 7.97 |

Read more:

Just know what when you’re picking an auto insurance provider that if you go with one that has low complaints, you’ll probably be better off.

Our recommendation

We’re here to give you all the facts and comprehensive data analysis you need to make your own insurance decisions.

Based on overall rankings, State Farm is our top choice because it ranks in the top five for market share, low complaints, and cheap pricing. Farmers and Allstate come in close by ranking in the top five for price and market share.

No matter which company you’re considering, there are licensed insurance agents who would love to help. Ask them questions or have them compare quotes for you based on your own driver profile. Call one today at [mapi-phone /] to get started.

Where We Found The Facts

We put all our sources under that handle little “source links” section below if you want to take a look. Or, you can just know that we’ve already crosschecked information and come up with calculations. The one thing you should know is that not every single car insurance company was surveyed in Illinois and to come up with the numbers, we used specific driver profiles that might not perfectly align with your life. What we’re saying is that the premiums might not be exactly what you pay for car insurance, but they’ll help you figure out how much you could expect to pay.

Source Links: