We want to do one thing: show your Colorado’s most affordable car insurance companies. If you were born on the slopes and like living a mile above the sea, this is the auto insurance page for you.

What Are You Looking For?

- Colorado’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Colorado Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What Are Colorado’s Cheapest Insurance Companies?

We looked at 54 companies, 20 cities, and four driver profiles (married, single, male, female, etc.), to find average annual rates for the average Colorado driver.

It’s no surprise to us that USAA is the cheapest car insurance provider with 30% of Colorado’s population in the military. With the Air Force academy just north of Colorado Springs, it makes sense that USAA would step up their game for service members there.

For all non-military drivers, you can look to Auto-Owners Insurance and Geico for some of the state’s cheapest overall rates based on our calculated premiums. You can also check out the rest of the list to see how the provider you’re considering stacks up price-wise.

Keep in mind, these are sample quotes. With your unique circumstances, the breakdown may not be the same. Some companies that come in higher on this list could offer you more affordable average rates. This is why it’s essential to get multiple quotes instead of just relying on the average rates.

| Average Annual Rate | |

|---|---|

| USAA | $1,453.36 |

| Auto Owners | $1,472.85 |

| Geico | $1,503.92 |

| CSAA | $1,507.60 |

| Horace Mann | $1,516.79 |

| 21st Century | $1,531.11 |

| Colorado Farm Bureau Mutual Insurance | $1,588.78 |

| California Casualty | $1,682.40 |

| Grange Mutual | $1,702.21 |

| Travelers | $1,741.23 |

| American National Financial | $1,753.88 |

| Mountain West Farm Group | $1,768.50 |

| Acuity - A Mutual Insurance Company | $1,849.28 |

| State Farm | $1,864.04 |

| Hallmark Financial | $1,870.85 |

| Pharmacists Mutual | $1,897.45 |

| Progressive | $1,942.33 |

| IAT Reins | $2,004.61 |

| Loya | $2,053.14 |

| Nationwide | $2,067.12 |

| American Family Ins | $2,068.96 |

| Ameriprise Financial Grp | $2,075.58 |

| Chubb | $2,113.07 |

| Country Insurances & Financial | $2,139.38 |

| Liberty Mutual | $2,168.32 |

| National General | $2,169.90 |

| Farmers | $2,250.42 |

| The Hartford | $2,260.72 |

| Secura Insurance | $2,290.20 |

| Palisades | $2,299.35 |

| Shelter Insurance | $2,329.85 |

| AIG | $2,433.65 |

| GuideOne Insurance | $2,447.92 |

| Esurance | $2,495.48 |

| Allstate | $2,499.42 |

| Kemper | $2,513.79 |

| Baldwin & Lyons | $2,611.61 |

| Titan | $2,622.73 |

| Dairyland | $2,633.58 |

| Central Mutual | $2,652.48 |

| Cincinnati Insurance | $2,663.62 |

| Western National | $2,697.59 |

| Kingsway | $2,850.64 |

| Safeway Insurance | $2,855.04 |

| Brickstreet Mutual | $2,868.25 |

| Amica Mutual | $2,901.97 |

| PURE | $3,009.84 |

| QBE Insurance | $3,203.44 |

| Safeco | $3,293.47 |

| State Auto Mutual | $3,386.26 |

| WBL | $3,663.07 |

| Electric Insurance | $3,685.27 |

| MetLife | $3,740.17 |

| EMC | $4,429.00 |

Read more:

- Why Amica Insurance Is The Best Choice

- Comparing State Farm And Amica: Which Insurance Provider Offers The Best Value?

- Dairyland Auto Insurance

How Much Do Drivers Like You Spend On Auto Insurance?

Every driver is different. To give you an idea of what you can expect to spend on auto coverage in Colorado, we collected data and analyzed premiums across age and status categories. Age and driving record play a substantial part in rates. But each insurance company places greater importance on different factors when pricing out collision coverage, liability per person, etc.

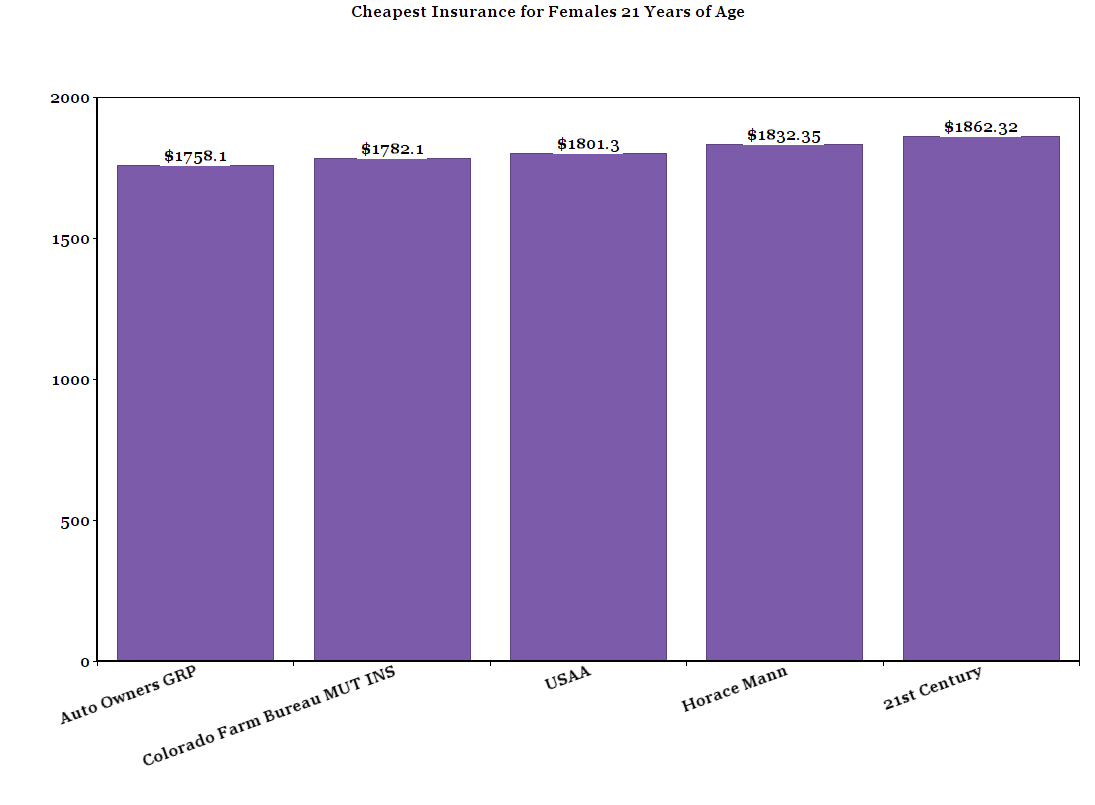

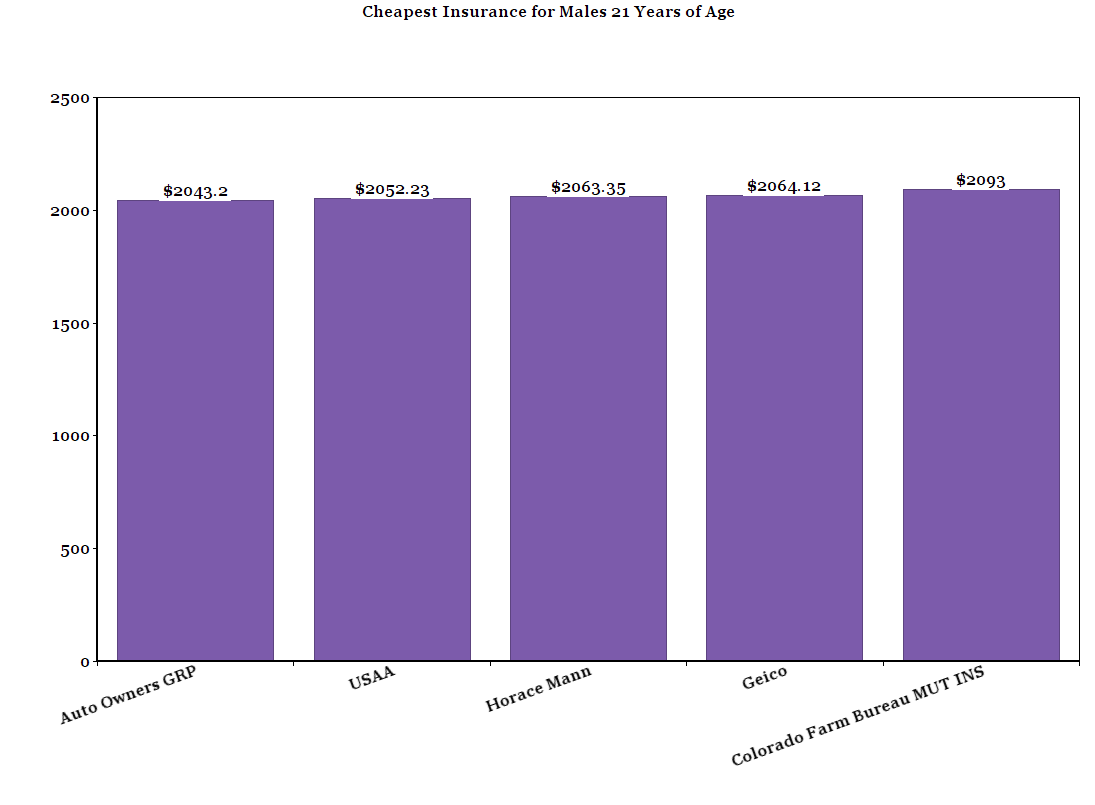

Cheapest For Drivers 21 and Under

We analyzed the driver profiles of 21-year old men and women with clean records to come up with these average annual premiums. With roughly 37,000 agents, Auto-Owners insurance tops our list of cheapest companies for drivers in this age group. USAA, Colorado Farm Bureau, Horace Mann, and 21st Century are close runner-ups, all being within $100 of Auto-Owners Insurance. See what other companies can offer you affordable car insurance if you are under the age of 21.

| Average Annual Rate | |

|---|---|

| Auto Owners Insurance | $1,900.65 |

| USAA | $1,926.76 |

| Colorado Farm Bureau Mutual Insurance | $1,937.55 |

| Horace Mann | $1,947.85 |

| 21st Century | $1,986.00 |

| Geico | $2,050.88 |

| CSAA | $2,110.80 |

| Travelers | $2,151.30 |

| Grange Mutual Casualty | $2,189.57 |

| California Casualty | $2,239.00 |

| American National Financial | $2,265.75 |

| Hallmark Financial Services | $2,373.30 |

| Acuity | $2,388.75 |

| IAT Reins | $2,436.26 |

| State Farm | $2,444.33 |

| Pharmacists Mutual | $2,479.75 |

| Loya | $2,554.60 |

| Progressive | $2,575.32 |

| Country Insurance & Financial Services | $2,585.92 |

| Mountain West Farm Group | $2,602.50 |

| National General | $2,612.53 |

Cheapest Insurance For Young Adults

Our research shows that women pay 16% less than their fellow 21-year old male friends in Colorado. Here’s where you’ll find the cheapest coverage for insured young men and women drivers:

Cheapest For Young Couples

According to our number crunching, you could see up to a 46% drop in auto insurance premiums between the ages of 18 and 35. This is based on average annual rates that we pulled for a 35-year old married male, with a clean driving record. CSAA Insurance was the most affordable at $904.40 while Nationwide was ranked 20th and only cost $500 more. Rates could drop more or less depending on what discounts you take advantage of, if you have other policies to combine, etc.

Cheapest For Drivers Over 65

After studying annual rates for a 68-year old woman, we learned that Colorado senior citizens can pay up to 19% less a year in car insurance premiums than 35-year olds. In many ways, older drivers are more experienced and lower risk drivers. With a clean driving record, combined policies, etc., the average cost drops quickly. CSAA Insurance is the cheapest which may come as a surprise, since its only sold car insurance in Colorado since 2003. Check out other cheap car insurance providers for this age group below.

| Average Annual Rate | |

|---|---|

| CSAA Insurance | $744.20 |

| Mountain West Farm Group | $841.90 |

| Geico | $919.70 |

| USAA | $921.08 |

| Horace Mann | $964.85 |

| 21st Century | $981.47 |

| Auto Owners Group | $995.90 |

| California Casualty | $1,027.00 |

| The Hartford | $1,038.89 |

| State Farm | $1,108.40 |

| American National Financial | $1,138.45 |

| Chubb | $1,141.70 |

| Colorado Farm Bureau Mutual | $1,170.80 |

| Pharmacists Mutual | $1,182.70 |

| Acuity - | $1,190.90 |

| Travelers | $1,209.40 |

| Grange Mutual | $1,214.86 |

| Dairyland | $1,223.80 |

| Hallmark Financial Services | $1,224.70 |

| Progressive | $1,237.23 |

Read More:

Can Your City Affect Your Rates on An Insurance Policy?

If you call the college town of Boulder home, you’ll pay almost $400 less a year than drivers in Denver, according to our data. While only about 30 miles apart, it demonstrates our next point: that you’ll pay different prices depending on where you live in Colorado. Here is the cheapest cities for car insurance in Colorado based on our analysis:

| Arizona Insurance by City | Average Annual Rate |

|---|---|

| Grand Junction | $1,974.60 |

| Boulder | $2,031.68 |

| Highlands Ranch | $2,084.59 |

| Westminster | $2,170.51 |

| Estes Park | $2,180.13 |

| Alamosa | $2,185.71 |

| Cortez | $2,192.04 |

| Durango | $2,221.19 |

| Gunnison | $2,264.00 |

| Steamboat Springs | $2,271.56 |

| Craig | $2,324.16 |

| Pueblo | $2,327.70 |

| Glenwood Springs | $2,337.51 |

| Sterling | $2,377.42 |

| Trinidad | $2,417.66 |

| La Junta | $2,420.13 |

| Aurora | $2,426.99 |

| Fort Morgan | $2,431.70 |

| Denver | $2,449.41 |

| Limon | $2,529.33 |

Read more: Get The Best Affordable Auto Insurance In Aurora

What Are The Most Popular Colorado Car Insurance Providers?

What we call “popularity” is also known as “market share.” It shows the percentage of customers a company has in an area compared to competitors. All you need to know is that the higher the number, the more customers they have, and the more popular of a choice they are.

In Colorado, State Farm takes the cake for the highest market share, but it’s also about $400 more expensive a year than cheaper companies, ranking as the state’s 14th cheapest option. This is the insight that market share can provide. Since State Farm is the most expensive, you have to wonder why that’s so. It could be that the company has better coverage or customer service. Different customers value things that don’t necessarily revolve around average rate. Consider that when you look at the market share by insurance company data below.

| Market Share % | Average Premiums | |

|---|---|---|

| State Farm | 20.06 | $1,864.04 |

| Progressive | 10.13 | $1,942.33 |

| Farmers | 9.2 | $2,250.42 |

| Allstate | 9.1 | $2,499.42 |

| USAA | 9.05 | $1,453.36 |

| Geico | 8.62 | $1,503.92 |

| American Family | 8.3 | $2,068.96 |

| Liberty Mutual | 5.39 | $2,168.32 |

| Nationwide | 2.12 | $2,067.12 |

| The Hartford | 1.99 | $2,260.72 |

Customer Satisfaction Ratings

A “complaint index” shows the percentage of customers who file complaints in comparison to a company’s market share. The lower the number, the less the complaints and the higher the probability that that company is pleasing its customers.

In Colorado, the top companies with the lowest complaint indexes all have zeros. Allstate on the other hand, has a little work to do in comparison. Check it out:

| Complaint Ratio | |

|---|---|

| American International | 0 |

| Amica Mutual | 0 |

| Country Insurance & Financial | 0 |

| Alliance Insurance | 0 |

| Zurich Insurance | 0 |

| Chubb | 0 |

| Nationwide | 0 |

| Secura Insurance | 0 |

| Travelers | 0 |

| Allstate Insurance | 0.22 |

Our Recommendation

We present the facts and let you do the decision making. That’s because you know what you need as a driver.

If you are going for cheap and all-around consistent ratings, Geico and USAA have high market share as well as a low average premium. We also discovered that Travelers is another cheap option that has good customer service and a low complaint index. Of course, you can only get USAA if you’re a military member, so if you’re not, that option is unfortunately out.

On the flip side, State Farm is one of the more expensive providers at about $1,000 more annually than the cheapest options but it also ranks the highest in market share and customer service. So does Nationwide.

If budget is a concern, go with a more affordable option that still ranks well in other categories. If the sky’s the limit for price and coverage, go with a company that is both popular and serves its customers well. If you still need help, give a licensed agent a call at [mapi-phone /]. They can help you find quotes and answers to your questions.

t a call at [mapi-phone /]. They can help you find quotes and answers to your questions.

Where We Found The Facts

We used all of the sources below to find this data and then put our heads to work deciphering it all. Why? To give you a better idea of what you can expect to pay as an insured Colorado driver with certain companies. The words to listen to here are “give you a better idea.” Since you’re different than your neighbor, you’ll have a unique premium. We just wanted to give you some averages so you know what to expect—ballpark—when you go looking for quotes.

Source Links:

- The Colorado Department of Regulatory Agencies

- Colorado Census