Looking for auto insurance premium averages, customer satisfaction ratings, or anything else about Maryland insurance? You can find it here. If you know how to pick a crab like nobody’s business, say “Bal-more” without a “t”, and cheer for the Ravens, this car insurance information is for you.

Maryland’s minimum coverage requirements for car insurance include bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. These are just the minimum requirements you need to drive legally in the state. It is wise to add collision coverage and comprehensive coverage to your auto insurance policy so you are covered for all possible scenarios. (For more information, read our “Maryland Car Insurance Requirements“).

What Are You Looking For?

- Maryland’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Maryland Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are Maryland’s cheapest car insurance companies?

We took the time to analyze 42 companies, 24 counties, and 11 driver profiles to determine average premiums by insurance provider. Since prices range from $1,000 to over $6,000 depending on which company you choose, being aware of the more affordable options can help you save.

| Cheapest Car Insurance in Maryland | Average Annual Cost |

|---|---|

| Doctors Co Group | $1,074.43 |

| Cumberland | $1,142.34 |

| Geico | $1,183.52 |

| Pharmacists Mutual | $1,295.11 |

| PURE | $1,297.50 |

| USAA | $1,303.94 |

| Amica Mutual | $1,330.86 |

| Cincinnati Insurance | $1,377.54 |

| IFA Insurance | $1,406.21 |

| Old Republic | $1,430.75 |

| CSAA | $1,529.39 |

| Selective Insurance | $1,536.22 |

| Horace Mann | $1,575.07 |

| Brethren Mutual | $1,644.03 |

| IDS | $1,693.91 |

| Erie | $1,696.54 |

| Chubb | $1,715.07 |

| Pennsylvania National | $1,745.24 |

| Liberty Mutual | $1,745.69 |

| State Farm | $1,798.79 |

| Travelers | $1,806.74 |

| Mutual Benefit | $1,875.84 |

| Main Street America Group | $1,887.89 |

| MetLife | $1,904.17 |

| ACE | $1,917.90 |

| State Auto Mutual | $1,922.71 |

| Progressive | $1,942.41 |

| Allstate | $1,954.45 |

| Nationwide | $1,974.82 |

| Esurance | $2,124.89 |

| Donegal Insurance | $2,178.24 |

| Elephant Insurance | $2,207.94 |

| Farmers | $2,302.07 |

| National General | $2,316.37 |

| Kemper | $2,320.88 |

| The Hartford | $2,461.91 |

| IAT Reins | $2,584.10 |

| Titan | $2,894.34 |

| American National | $3,736.00 |

| Dairyland | $4,224.63 |

| Public Service Group | $4,664.02 |

| Hallmark Financial Services | $6,034.20 |

How much do drivers like you spend on car insurance?

Every driver is different, so every driver can expect to get a different rate for auto insurance. That’s why we took this a step further and created categories that might more closely align with your life so you will have a better idea of what to expect when it comes to your auto insurance rates.

Cheapest For Drivers Under 25

We looked at driver profiles of 23-year old single men and women and 18-year old men with state minimum liability insurance to come up with these premiums. If you’re in the age group, you might be paying premiums close to these below.

| Average Annual Cost | |

|---|---|

| Geico | $1,063.79 |

| IFA Insurance | $1,469.38 |

| Horace Mann | $1,617.68 |

| USAA | $1,690.14 |

| Pharmacists Mutual | $1,809.56 |

| Cincinnati Insurance | $1,816.75 |

| PURE Companies Group | $1,935.35 |

| MetLife | $2,129.00 |

| IDS Insurance | $2,165.00 |

| Cumberland | $2,267.02 |

| Amica Mutual | $2,311.88 |

| Erie | $2,321.68 |

| State Farm | $2,360.35 |

| Travelers | $2,531.78 |

| Brethren Mutual | $2,545.71 |

| Progressive | $2,545.72 |

| CSAA | $2,547.88 |

| Selective Insurance | $2,564.71 |

| IAT Reins | $2,584.10 |

| Nationwide | $2,618.63 |

| Chubb | $2,646.23 |

| Mutual Benefit | $2,691.91 |

| Old Republic | $2,696.13 |

| Elephant Insurance | $2,794.15 |

| Pennsylvania National | $2,806.58 |

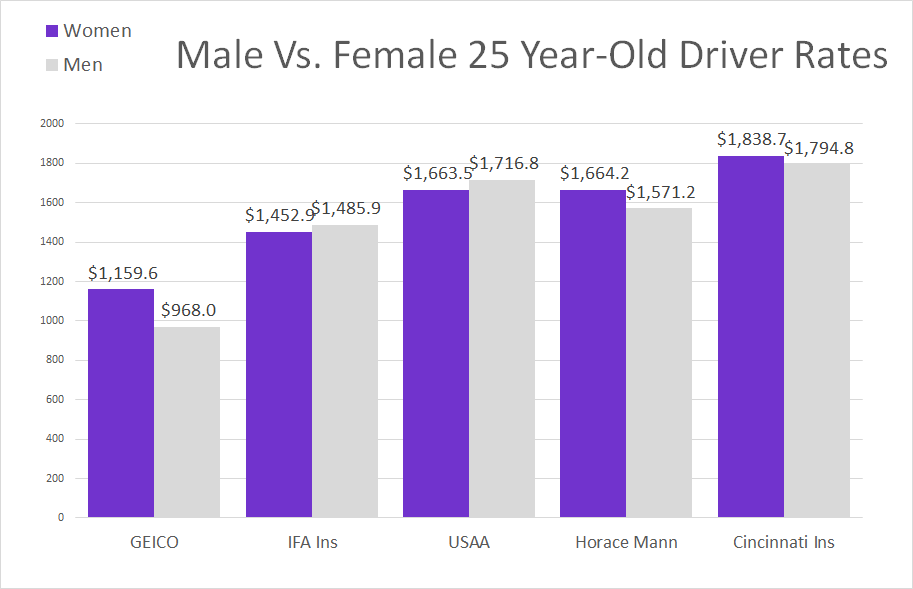

We found that in Maryland, men pay about 6% less for car insurance under the age of 25. Geico has the largest gender gap, with IFA and Cincinnati being similar. Below you will see how the three most affordable companies vary in rates by gender.

*USAA and Horace Mann only sells to to military members and their families–Horace Mann only teachers, we took them out of the following analysis.

Cheapest For Drivers Over 50

After researching driver profiles of a 65-year old single women with standard coverage and 50 and 65-year old single men with the same standard coverage, we found the cheapest rates for your age group. Check it out.

| Average Annual Cost | |

|---|---|

| Old Republic | $575.52 |

| Cumberland | $653.25 |

| Pharmacists Mutual | $688.00 |

| Geico | $713.52 |

| PURE | $729.77 |

| CSAA | $746.08 |

| USAA | $791.96 |

| Selective Insurance | $812.83 |

| Main Street American Group | $815.57 |

| Cincinnati Insurance | $823.01 |

| Pennsylvania National Insurance | $851.04 |

| State Auto Mutual | $854.40 |

| MetLife | $983.68 |

| Amica Mutual | $1,025.90 |

| IDS | $1,026.27 |

| IFA | $1,036.68 |

| Erie | $1,059.73 |

| State Farm | $1,131.54 |

| Donegal Insurance | $1,149.75 |

| Brethren Mutual | $1,158.24 |

| ACE | $1,201.24 |

| Mutual Benefit | $1,202.22 |

| Chubb | $1,222.80 |

| Allstate | $1,225.28 |

| Progressive | $1,229.08 |

| Travelers | $1,243.55 |

| Esurance | $1,254.48 |

| Horace Mann | $1,255.75 |

| National General | $1,267.14 |

| Liberty Mutual | $1,331.28 |

| Nationwide | $1,375.99 |

| The Hartford | $1,391.01 |

| Farmers | $1,700.76 |

| Elephant Insurance | $1,760.24 |

| Kemper | $1,797.56 |

| Titan | $2,173.72 |

| Dairyland | $3,528.54 |

Read more: Cheapest Car Insurance for Drivers 50 and Over

Cheapest For Young Families

To come up with this data, we analyzed profiles of people who were 24-25-years old and married with one toddler and 250/500/100 coverage. Here’s where people like this can find the cheapest auto coverage.

| Average Annual Cost | |

|---|---|

| Old Republic | $929.11 |

| Main Street American | $1,047.33 |

| CSAA | $1,148.89 |

| Pharmacists Mutual | $1,214.67 |

| Geico | $1,241.15 |

| PURE | $1,317.19 |

| Erie | $1,335.46 |

| State Auto Mutual | $1,346.22 |

| Cumberland | $1,374.52 |

| Doctors Co Group | $1,379.56 |

| Brethren Mutual | $1,392.96 |

| USAA | $1,403.06 |

| IDS | $1,450.37 |

| Cincinnati Insurance | $1,462.56 |

| Amica Mutual | $1,474.06 |

| Selective Insurance | $1,486.26 |

| Allstate | $1,515.00 |

| Pennsylvania National Insurance | $1,631.33 |

| National General | $1,701.94 |

| MetLife | $1,730.00 |

| IFA | $1,782.67 |

| Esurance | $1,821.85 |

| Liberty Mutual | $1,844.33 |

| Horace Mann | $1,859.99 |

| State Farm | $1,981.59 |

| Progressive | $2,004.22 |

| Elephant Insurance | $2,022.11 |

| Mutual Benefit | $2,088.78 |

| Chubb | $2,219.56 |

| ACE | $2,320.81 |

| Travelers | $2,326.24 |

| Kemper | $2,413.63 |

| Nationwide | $2,467.91 |

| Farmers | $2,602.58 |

| The Hartford | $2,617.96 |

| Titan | $4,129.81 |

| Dairyland | $3,528.54 |

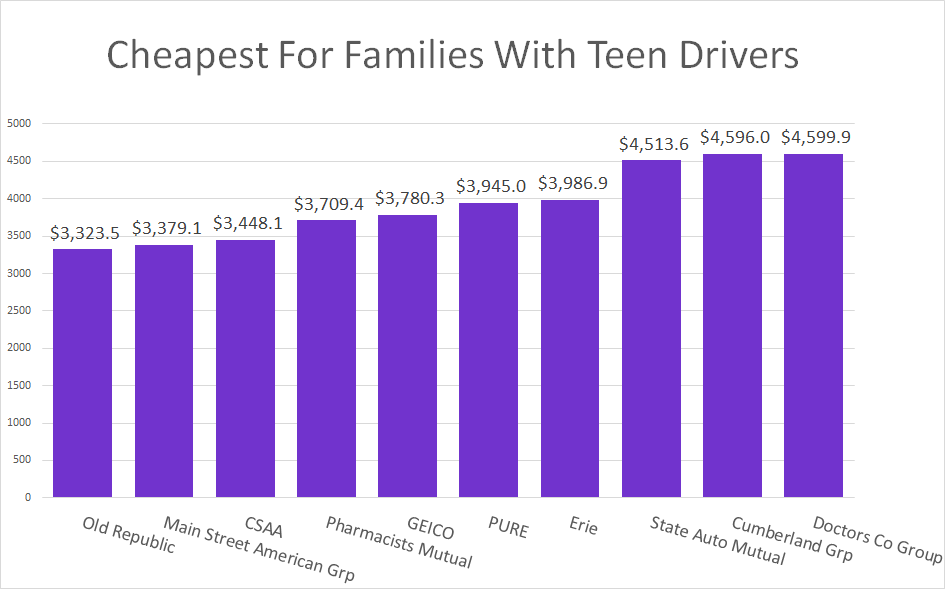

Cheapest For Families With Teen Drivers

While we looked at a couple who were 44 with a 17-year old son and standard coverage, if you are in a similar boat, here’s where you can look for cheaper options:

Auto insurance companies also look at your credit score and driving record when assigning your rate. If you have poor credit or you don’t have a clean driving record, you can still find affordable auto insurance coverage by looking for companies that offer insurance discounts. Many auto insurance providers offer student discounts to help keep teen drivers’ rates reasonable. You might also get a discount for taking a defensive driving course or enrolling in paperless billing or automatic payments. Sometimes finding cheap car insurance comes down to which companies have the most insurance discounts you’re eligible for.

What are rates like in the city?

Whether you’re relaxing in the country by the Eastern Shore or city slicking in Baltimore, you’ll pay a unique rate for auto coverage. Here are some average city premiums for Maryland:

| Insurance Costs by City | Average Annual Cost |

|---|---|

| Oxford | $1,374.46 |

| Frederick | $1,375.78 |

| Hagerstown | $1,639.53 |

| Chesapeak Beach | $1,645.80 |

| Chrisfield | $1,647.14 |

| Kingstown | $1,652.23 |

| Dover | $1,664.15 |

| Cambridge | $1,671.16 |

| Denton | $1,675.38 |

| Ocean City | $1,688.60 |

| Cumberland | $1,696.04 |

| Salisbury | $1,702.96 |

| Westminster | $1,755.57 |

| Saint Mary's | $1,828.78 |

| Annapolis | $1,829.04 |

| Elkton | $1,842.16 |

| Aberdeen | $1,865.00 |

| Ellicott City | $1,941.09 |

| La Plata | $2,017.76 |

| Upper Marlboro | $2,354.21 |

| Baltimore | $2,372.33 |

| Baltimore City | $2,843.21 |

| Glen Burnie | $2,886.00 |

| Silver Springs | $2,905.96 |

| Columbia | $3,270.40 |

| Rockville | $3,321.60 |

| Waldorf | $3,518.00 |

| Germantower | $3,966.50 |

| Gaithersburg | $4,079.00 |

What are the most popular Maryland car insurance providers?

Market share measures the percentage of customers a company has compared to competitors. It tells you a lot more about a company than meets the eye too. Geico, for example, is Maryland’s number one auto insurer selling almost one quarter of all the state’s car insurance policies. They’re not the cheapest option though. They’re actually over $100 more expensive a year than the cheapest provider in Maryland for an average driver. State Farm is another example since they have a large portion of market share but their policies are close to $800 more expensive than the cheapest option.

| Premiums Written | Market Share Percent | |

|---|---|---|

| Geico | 917,444.00 | 22.51 |

| State Farm | 803,224.00 | 19.71 |

| Allstate | 513,438.00 | 12.6 |

| Nationwide | 353,179.00 | 8.66 |

| USAA | 316,650.00 | 7.77 |

| Erie | 292,782.00 | 7.18 |

| Progressive | 232,095.00 | 5.69 |

| Liberty Mutual | 211,553.00 | 5.19 |

| Travelers | 50,364.00 | 1.24 |

| The Hartford | 50,031.00 | 1.23 |

This tells you right there that people are paying for certain providers for another reason than price. It could be that they have great customer service or coverage options, but whatever it is, it’s causing the most drivers to choose them and it might bode well for you to do the same.

Which auto insurance companies have the most customer complaints?

A “complaint index” measures the percentage of customers who complain versus the market share a company has. The lower numbers mean less people are complaining while the higher numbers indicate more complaints. Let’s look at the complaint index customer satisfaction scores.

| Complaint Index | ||

|---|---|---|

| Esurance | 0.42 | |

| Nationwide | 0.43 | |

| Progressive | 0.46 | |

| Geico | 0.52 | |

| Allstate | 0.68 | |

| Titan | 0.74 | |

| State Farm | 0.89 | |

| AAA | 0.99 | |

| Safeco | 1.01 | |

| Kemper | 1.02 | |

| Encompass | 1.09 | |

| Brethren Mutual Insurance Company | 1.11 | |

| Agency Insurance Company | 1.28 | |

| Liberty Mutual | 1.38 | |

| Ameriprise | 1.52 | |

| USAA | 1.55 | |

| Erie Insurance | 1.72 | |

| Hartford | 1.72 | |

| Selective Insurance | 1.82 | |

| 21st Century | 1.99 | |

| State Auto | 2.03 | |

| Amica | 2.75 | |

| Peninsula Insurance | 3.02 | |

| Penn National Insurance Company | 3.09 | |

| MetLife | 3.62 | |

| Travelers | 3.64 |

You should care because companies like Esurance have the state’s happiest customers on average and Travelers has the least. It’s just something else to consider when choosing a company because if more customers are content, there is a better chance you will be too.

What do we recommend?

You should choose whatever insurance company you want. We just want to give you all the information you need to do so.

In Maryland, Nationwide fell right over the state average for car insurance $1,824 but they ranked second for the best complaint index and fourth for highest market share. If you go for a company like this that is great across multiple categories, it can be a smart choice. Don’t limit your options to just the cheapest insurance companies, or even the largest car insurance companies. Look for the all around best provider you can find.

There’s an entire team of insurance savants who are ready to help you Old Line Staters if you’re feeling lost. Take the pressure off yourself and give licensed agents a call today if you still need help.

Where We Found The Facts

See those links at the bottom of the page? That’s where we found all of this information. What you see on this page as far as premiums go may not be true for you. The numbers aren’t made up, but they were calculated for a very specific audience that you may not 100% align with. The only way to know a premium for sure is to call for a quote. What we have here is just meant to help give you an idea of what you could pay for car insurance in Maryland.

Source Links:

- Maryland Insurance Department

- Complaint Information