If you are a desert dweller, prefer to call the lake and the mountains home, or spend your nights on the Strip, this page is for all you Nevada drivers. We think you’ll love finding easy, understandable, and complete insurance information in one place. When it comes to companies, it doesn’t matter if you are looking for the cheapest, most popular, or best customer service providers–we’ve got you covered.

Nevada’s minimum coverage requirements are for bodily injury liability coverage and property damage liability coverage only. However, these are just the minimum insurance requirements to drive legally in the state. Liability insurance only covers other drivers’ damages in an auto accident you cause. For your own damages to be covered, it is recommended you add collision coverage and comprehensive coverage to your auto insurance policy.

What Are You Looking For?

- Nevada’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- City Rates

- Most Popular Nevada Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are Nevada’s cheapest car insurance companies?

We took a deep look at nine cities and a few driver profiles to find average rates for 18 auto insurance companies. Safeco and The Hartford came in as the two most affordable, with a difference of only $2. At $873.22 and $875.11 respectively, you can pay less than $75 a month with either option. Geico, the third cheapest company, is about 16% more expensive with average annual rates at $1,018.16 according to our research.

Since the cheapest is under $900 and the most expensive surges over $2,500, you’ll want to take a look so you don’t spend too much when you sign up for a policy.

| Average Annual Rates | |

|---|---|

| Safeco | $873.22 |

| The Hartford | $875.11 |

| Geico | $1,018.16 |

| Liberty Mutual | $1,058.67 |

| Progressive | $1,248.16 |

How much do drivers like you spend on auto insurance coverage?

No driver is the same. Some are women. Some are men. Some happen to get into accidents more than others. We feel like we’re writing a kid’s book here, but what we’re trying to say is that we’ve taken it a step further. We’ve found auto premium averages for certain types of drivers, because at the end of the day your driver profile will ultimately determine your annual rate. Take a look at the group that is most like you.

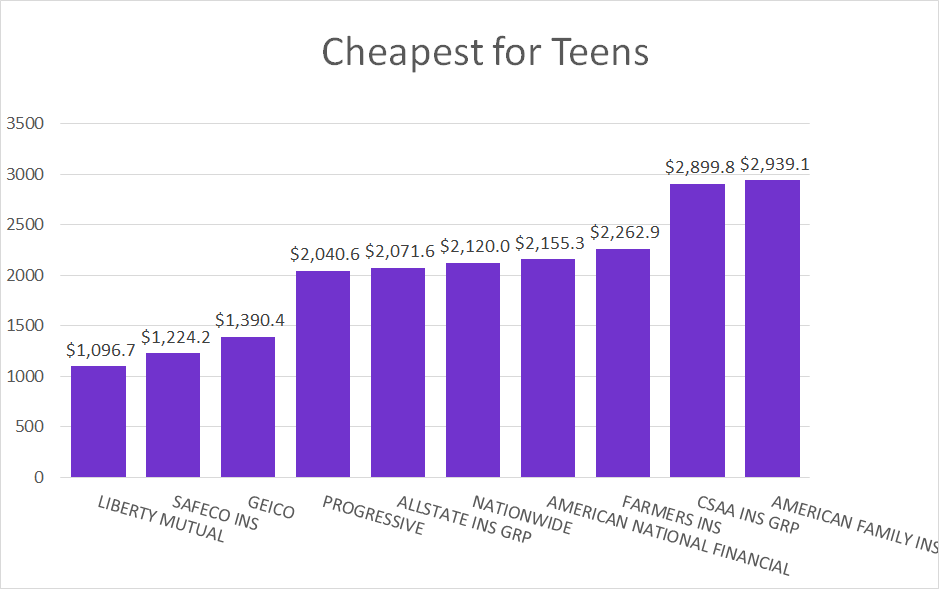

Cheapest For Teens

Statistically, teens get into more accidents than other age groups. That’s why insurance rates for auto coverage will be a bit higher. We’ve found that teen girls usually pay a little less than guys, but here are the average rates for teen boys who are 17-years old to give you an idea of prices.

Cheapest For Married Couples

Tie the knot? You’ll be able to cash in on tax breaks and cheaper auto coverage. Safeco, Geico, and Liberty Mutual provide the lowest rounds in our analysis. And with less than $200 separating the three, depending on your age, gender, and location they are all great Here are the averages in Nevada for married couples:

| Chepaest for Married Drivers | |

|---|---|

| SAFECO INS | $681.04 |

| Geico | $729.63 |

| LIBERTY MUTUAL | $841.48 |

| THE HARTFORD | $875.11 |

| AMERICAN NATIONAL FINANCIAL | $941.63 |

| PROGRESSIVE | $959.63 |

| USAA | $1,002.80 |

| NATIONWIDE | $1,134.37 |

| STATE FARM | $1,150.78 |

| FARMERS INS | $1,151.81 |

| ALLSTATE INS GRP | $1,217.78 |

| AMERICAN FAMILY INS | $1,390.48 |

| CSAA INS GRP | $1,443.70 |

| CIG | $1,523.59 |

| NEVADA GENERAL INS CO | $1,560.67 |

| ESURANCE | $1,661.63 |

| DAIRYLAND | $1,829.78 |

| PRIMERO INS CO | $2,270.22 |

Cheapest For Single Nevada Drivers

Your state is number eight in the country for having the most singles, so while you’re driving around looking for all the other fish in the sea, know that this is what it’ll most likely cost you for car insurance.

| Cheapest for Single Drivers | |

|---|---|

| SAFECO INS | $1,161.50 |

| LIBERTY MUTUAL | $1,384.44 |

| Geico | $1,450.94 |

| PROGRESSIVE | $1,680.94 |

| FARMERS INS | $1,751.89 |

| USAA | $1,758.71 |

| NATIONWIDE | $1,842.00 |

| ALLSTATE INS GRP | $2,025.06 |

| CIG | $2,197.86 |

| CSAA INS GRP | $2,225.56 |

| STATE FARM | $2,418.12 |

| AMERICAN NATIONAL FINANCIAL | $2,431.61 |

| ESURANCE | $2,434.44 |

| AMERICAN FAMILY INS | $2,596.06 |

| NEVADA GENERAL INS CO | $2,712.30 |

| DAIRYLAND | $3,151.60 |

| PRIMERO INS CO | $3,553.48 |

*All of these averages were based on prices for men and women who are 17, 23, and 30.

Cheapest For Women

Women make up nearly half of all people in Nevada. Here’s where you can find the cheapest premiums for car insurance in Nevada:

| CHEAPEST FOR WOMEN | |

|---|---|

| SAFECO INS | $1,072.36 |

| THE HARTFORD | $1,075.89 |

| USAA | $1,309.69 |

| LIBERTY MUTUAL | $1,317.02 |

| Geico | $1,360.40 |

| PROGRESSIVE | $1,466.82 |

| FARMERS INS | $1,540.44 |

| NATIONWIDE | $1,627.56 |

| STATE FARM | $1,827.28 |

| ALLSTATE INS GRP | $1,868.40 |

* We looked at average pricing for women 23 and 30 and came up with these premiums.

Cheapest For Men

Men make up 50.3% of the state’s population. Looking at single men who were 17 and 45, we found these average premiums for you fellows.

| CHEAPEST FOR MEN | |

|---|---|

| LIBERTY MUTUAL | $891.56 |

| SAFECO INS | $897.44 |

| Geico | $966.00 |

| PROGRESSIVE | $1,438.61 |

| AMERICAN NATIONAL FINANCIAL | $1,486.11 |

| NATIONWIDE | $1,513.44 |

| ALLSTATE INS GRP | $1,554.89 |

| FARMERS INS | $1,743.44 |

| AMERICAN FAMILY INS | $1,991.25 |

| PRIMERO INS CO | $1,997.33 |

In addition to age, gender, and marital status, auto insurance companies consider your credit history and driving record when assigning your rate. If you have high insurance costs because of poor credit or a bad driving record, make sure to look into insurance discounts. Discount options include the good student discount offered to young drivers and the discount for active military members. Your insurance carrier might also offer a discount for taking a defensive driving course or enrolling in automatic payments, along with additional perks for being claim-free.

What are average rates in the cities?

There’s another factor that will change your rates: where you live. Yup, you got it. Nevada car insurance rates vary considerably depending on the ZIP code. Take Reno and Las Vegas for instance. They’re a day’s drive apart, but they still differ by about $500 annually when it comes to insurance. Look at the numbers below to get a better handle on how much you might be paying for car insurance in Nevada depending on where you live.

| Cheapest in Nevada | |

|---|---|

| Elko | $1,239.95 |

| Fallon | $1,250.27 |

| Carson City | $1,301.17 |

| Reno | $1,402.13 |

| Stateline | $1,426.82 |

| Pahrump | $1,484.25 |

| Henderson | $1,738.91 |

| Las Vegas | $1,977.43 |

| North Las Vegas | $2,089.12 |

What are the most popular Nevada car insurance providers?

Looking at a company’s “popularity”—or how we like to call it in the biz, “market share”—will help tell you the whole story about how they’ll be as an insurance provider.

How’s that so? Take State Farm for example. It has the highest market share at nearly 20%. That means it has 20% of the state’s insured drivers on their policies compared to competitors. It doesn’t have the cheapest rates though. It’s actually number 13 when it comes to Nevada’s cheapest insurance companies. What does that tell you? That more customers are willing to pay more for State Farm’s service because of other factors. It could be that it has better coverage and customer service because a company like Safeco the cheapest auto coverage provider in Nevada doesn’t even make the list for market share.

It’s just something to think about when you’re shopping for a new insurance company. Take a look:

| Most Popular Carriers | Market Share | Rate |

|---|---|---|

| STATE FARM GRP | 17.9 | $1,562.66 |

| Geico | 10.78 | $1,018.16 |

| PROGRESSIVE GRP | 10.54 | $1,248.16 |

| ALLSTATE INS GRP | 9.97 | $1,540.69 |

| FARMERS INS GRP | 9.91 | $1,391.84 |

| LIBERTY MUT GRP | 5.64 | $1,058.67 |

| USAA | 5.56 | $1,300.07 |

| CSAA INS GRP | 5.45 | $1,756.44 |

| AMERICAN FAMILY INS GRP | 3.43 | $1,856.27 |

| HARTFORD FIRE & CAS GRP | 3.01 | $875.11 |

Which auto insurance companies have the most customer complaints?

If you lodge a complaint against a company, don’t think the person on the other line flushes it down the toilet. A “complaint index” is the percentage of people who complain about a company compared to its market share. The good thing about it is that it shows you how much customers complain about certain companies. The lower their number (zero is best), the less complaints they get. State Farm, Geico, USAA, Liberty Mutual and the other companies with zero are the best at keeping their customers happy. 21st Century is undoubtedly the worst and has an exceptionally high number of complaints which is no good. Let’s look at the complaint index customer service ratings.

| Insurance Carrier | CPI |

|---|---|

| State Farm | 0 |

| Geico | 0 |

| USAA | 0 |

| Liberty Mutual | 0 |

| Safeco | 0 |

| Travelers | 0 |

| Esurance | 0 |

| Infinity Auto | 0 |

| Key Insurance Company | 0 |

| Nationwide | 0 |

| MetLife | 0 |

| Mendakota Insurance | 0 |

| Progressive | 0.04 |

| Farmers | 0.05 |

| Allstate | 0.11 |

| Hartford | 0.15 |

| Loya Group | 0.33 |

| American Family | 0.37 |

| Mercury Insurance | 0.45 |

| CSAA Insurance | 0.54 |

| Ameriprise | 0.72 |

| American Access Insurance | 1.06 |

| Country Financial Insurance | 1.93 |

| Dairyland | 2.83 |

| ANPAC | 3.81 |

| 21st Century | 23.22 |

Read more:

This is all to show you how you might feel as a customer when you pick a certain provider. Take a look so you don’t miss a beat.

What do we recommend?

Our advice is for you to make up your own mind after reading all of this information! We don’t mean to leave you with the big choice, but you know you best so you know what car insurance is going to be best for you too.

The one other piece of advice we want to give you is that when you choose a provider, pick one that scores well across a bunch of things. Don’t just go for cheap price, because they might have terrible customer service. On the flipside, don’t go for the most expensive because you think you’ll get more, as you may not.

In Nevada, Geico Insurance Agency is the only company that ranked in the top five for market share, complaint index, and cost. Liberty Mutual and USAA both ranked in the top ten for those three categories. Based on our rule above, these would be great choices for most drivers based on overall ranking.

Read more: Top auto insurance Companies Operating Today

Where We Found The Facts

None of this was created in our imaginations. It all came from cold hard facts. You can double check the links below if you’d like, or just listen to us when we say that our business is to bring you true, simple, and in-depth insurance information. The only thing you might find to be different is your insurance quote when you call to shop for an auto insurance provider. The numbers we have here are all based off of real customer profiles, but yours might not be exactly the same. This is all just to show you how much you might pay for insurance.

Source Links:

- valuepenguin.com

- https://doi.nv.gov/uploadedFiles/doinvgov/_public-documents/News-Notes/Auto_Guide.pdf

- https://www.bestplaces.net/docs/studies/solocities_list1.aspx